At Nomadtax, we believe you can become wealthy in one of two ways: either by working more, having no free time, holding multiple jobs, and accumulating some wealth, or by reducing your expenses.

It’s a common mistake to think that your biggest expense is rent, travel, or entertainment. It’s not! The biggest expense is taxes. Take a minute to sit down and calculate how much you spend on taxes each month.

Make sure to account for all taxes, not just personal income tax, but also social security, capital gains, property, pensions, and others, depending on the country you live in. Do it at least once; most people have never calculated the exact amount. You’ll be surprised when you do. Most of you will be surprised by the figure you come up with.

And when you get the figure, some may wonder, ‘So what? Everyone pays the same. I can’t do anything about it.’ This is incorrect. It’s not always possible to pay 0% in taxes or a very low tax rate, but if some people can do it, why can’t you do the same? Why not consider tax strategies and pay less? You can have a better quality of life.

And today, we will talk about a country known as the second Switzerland. Why? Because it has a picturesque landscape and is also recognized as a tax haven for savvy investors due to its low tax burden. Today we talk about tax residency in Andorra.

Indice del artículo

Choose the Right Model to Enjoy Tax Residency in Andorra

So, what options do you have in Andorra? Andorra offers two types of residencies tailored to different lifestyles. First, we have the Active Residency. This option allows you to register a company without substantial investments. Your company just needs to be active, either in trade or the provision of services.

The second option is the Passive Residency. Essentially, it’s a golden visa for Andorra, involving an investment of 600,000 euros in the Andorran economy. Real estate is also an option. Recently, Andorra banned the sale of properties to non-residents as the real estate market is saturated. So, if you were planning to buy something in Andorra, you’ll have to wait until 2024 when the ban is lifted, or simply apply for passive residency.

If you don’t have the additional 600,000 euros to invest, you can open a company there. The primary benefit of having a company in Andorra is that:

- You have the possibility to live in Andorra; and

- The tax you will pay is only 10%, which is one of the lowest in Europe.

Registration Time for a Company in Andorra

As I mentioned earlier, you can’t have a simple holding company in Andorra. You must engage in some business activity. For this reason, registering a company is not a quick process like in some countries, such as the UK, where it only takes a day to register a company. In Andorra, it takes about 12 weeks.

Why does it take so long? Because a special committee will assess what the company’s activity will be, what the expected turnover and income will be. So, you need to gather all this information and submit it to the government.

After getting government approval, you must contact the banks and undergo a compliance check. Once the account is approved, the company is registered by a notary. It takes a couple of weeks for the information to be recorded in the registry.

You also need to provide information about the business’s location. But keep in mind that it must be a physical location. It can be a co-working space or your home office, it doesn’t matter, but it must exist physically. In Andorra, you can’t simply have a registered address, as is the case in many other countries.

At the same time as you provide information about the company’s address, you can also apply for a residence permit. So, basically, after 12 weeks, you will have both a company opened and a residence permit.

Active Residency in Andorra

As mentioned earlier, if you wish to do business in Andorra and establish a company in this country, active residency is likely the most suitable option for you to obtain your tax residence in Andorra.

Of course, there are some additional rules to be followed, such as owning at least 34% of the company’s shares. You can either buy an existing one or create a new one; it doesn’t matter, but in the end, the minimum amount of shares you must have is 34%. It’s also crucial that to live there, you must be the director of your company and register as self-employed.

This, of course, entails an additional tax burden for you. And you can’t simply hire someone else to manage the company in your place. You must be an active manager. You would also need to make a deposit of 50,000 euros. Don’t worry; it’s not a gift to Andorra, you’ll get this money back when you leave the country.

Costs of Maintaining a Company in Andorra

But why am I saying all of this? To help you understand the real cost of maintaining a company. A 10% tax rate is a very good option. However, whenever you’re thinking about relocating to one country or another to register a business, always calculate all the expenses involved.

Consider not just the taxes but also the actual costs. Andorra can be a very good option due to its taxation, reputation, and the opportunities it offers, but since substance is expensive, always make sure that it’s worth it in your specific case.

It also depends on what your ultimate goal is. Given that there is no inheritance tax, no wealth tax, and a maximum income tax rate of 10%, you can play around with that to assess whether moving there is a good choice. In most cases, capital gains are also tax-free.

Passive Residency

If you like low taxes but don’t need a company, get passive residency through investment. With an investment of 600,000 euros, you can live in a well-developed and stable country that isn’t affected by bad news in the world. In addition to the investment, you’ll need to have a clean criminal record and an income exceeding 300% of Andorra’s minimum wage.

The main benefit is that you only need to stay in Andorra for 90 days to become a tax resident. Most countries require at least 183 days. In case you don’t want or can’t spend half a year in a country but still prefer to stay in Europe, choose between Cyprus and Andorra.

Cyprus allows you to stay for only 60 days, and Andorra for 90. The rest of Europe isn’t as generous; the 183-day rule applies. So, make an investment, and then you can pay the 10% tax.

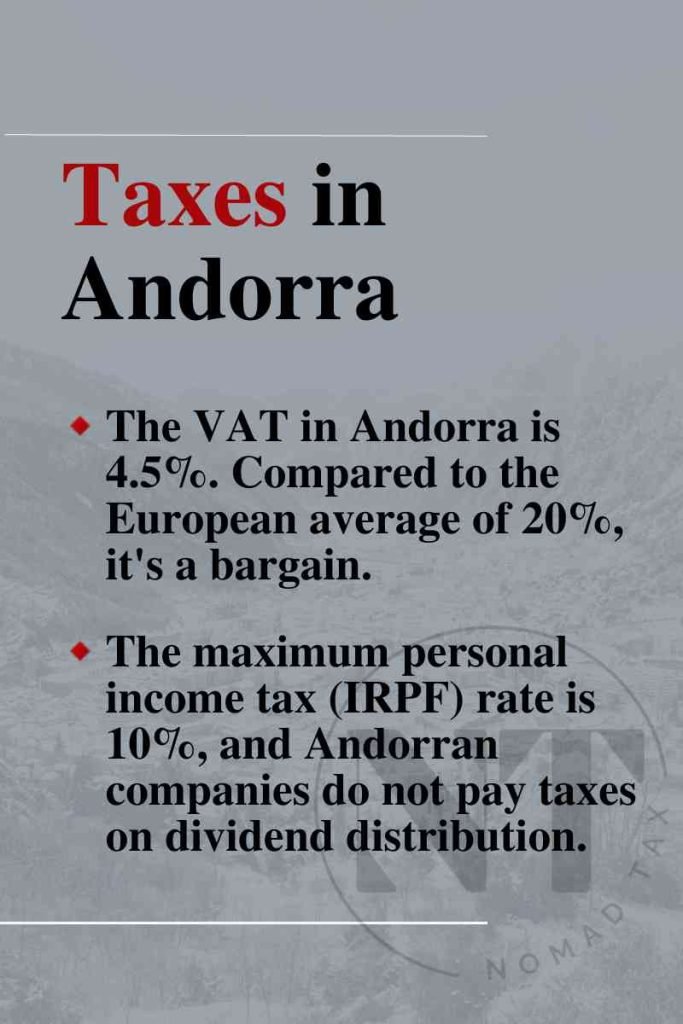

Taxes in Andorra

Very well, although we’ve provided a general overview of the taxes, it’s time to analyze them in detail, one by one, for a complete and accurate understanding.

Andorra boasts one of the most favorable tax systems in Europe. This makes it an attractive option for those looking to optimize their tax burden.

For residents in Andorra, the main tax is the Personal Income Tax (IRPF). In addition to IRPF, there’s also the General Indirect Tax (IGI) and the Corporate Tax, which we’ll explore in more detail in later sections.

How much is IRPF in Andorra?

The Personal Income Tax (IRPF) in Andorra is characterized by significantly lower rates compared to most European countries. In Andorra, IRPF is not applied to salaries below 24,000€, and beyond this amount, the rate gradually increases in relation to each worker’s income. It reaches a maximum of 10% for salaries exceeding 40,000€. It’s important to note that this maximum rate in Andorra is significantly lower than the maximum rate in Spain, which stands at 50%.

Additionally, Andorra offers some exemptions and tax benefits that are worth mentioning:

- Exemption of the first €3,000 of investment income.

- 100% exemption on the first €24,000 of earned income, with a 50% deduction on the next €16,000.

- Total exemption of dividends issued by an Andorran company and received by an Andorran resident.

- No taxes are withheld on dividends from Andorran companies for non-residents.

VAT or IGI in Andorra

The IGI, equivalent to VAT in Spain, is applied at a general rate of 4.5%, with a super-reduced rate of 0% and a reduced rate of 1%. In comparison, in Spain, VAT is generally at 21%, with a reduced rate of 10% and a super-reduced rate of 4%. It’s important to highlight that the IGI in Andorra is among the lowest in Europe.

The super-reduced rate of IGI is typically applied to the rental of housing and gold intended for investment. On the other hand, the reduced rate applies to food and water for consumption and irrigation.

Additionally, there is a special IGI at a rate of 2.5% applied to services such as passenger transport, art, antiques, and services provided by non-profit private organizations, such as libraries and fairs, among others.

Andorra also offers reductions in certain areas, such as healthcare, which is taxed at 0%, and education, which can be as low as 1%.

Corporate Tax in Andorra

The Principality is an ideal location for both multinational corporations and small and medium-sized enterprises (SMEs).

With a corporate tax in Andorra that is set by law at a maximum of 10%, but can be reduced to as low as 2% depending on the type of company, it positions itself as one of the lowest in all of Europe.

Both establishing a company in Andorra and setting up a company’s headquarters in the Principality are options worth considering, whether for SMEs or larger enterprises.

Most importantly, regardless of your strategy, think about what you’re doing exactly, whether you’re living in the most efficient way, and whether you’re accumulating wealth. Wealth today means more freedom. So, stay informed and minimize your taxes to maximize your wealth.

The Digital Nomad Visa in Andorra

The digital nomad visa in Andorra is a novel residence permit that adds to the existing options of active and passive residency. This visa is designed for foreign individuals who meet the following criteria:

- They perform their work remotely using information and communication technologies (computers, online communication, social media, among others).

- They don’t need a fixed geographical location to carry out their work.

- They provide services to clients residing outside the Principality of Andorra.

This visa provides digital nomads the opportunity to legally reside in Andorra and enjoy a favorable environment for remote work, without being tied to a specific geographic location for their employment.

Requirements to Enjoy the Digital Nomad Visa in Andorra

Up to this point, everything seems straightforward. You’re a digital nomad who wants to explore the world, works online, and has clients outside the Principality of Andorra. However, there are other aspects you need to consider.

To obtain the digital nomad residence permit in Andorra, it’s important to note that you will need approval from the Andorran government. While the Andorran government has not yet fully defined who is eligible for this type of digital nomad visa, there are some requirements to keep in mind:

In addition to the previously mentioned requirements, it’s necessary to consider the following:

- Approval from the Andorran Ministry of Economy, which will be responsible for recognizing you as a remote worker.

- You cannot have a criminal record, as with many other global visas.

- You will need to prove that you have sufficient financial means to support yourself during your period of residence in Andorra.

- You’ll need to have a physical address in Andorra, whether rented or purchased, to demonstrate that you have a place to stay.

- You’ll also need health insurance and undergo medical examinations in Andorra.

What Benefits Does the Digital Nomad Visa in Andorra Offer?

As you may have noticed, the requirements are not exactly few. Unlike many other countries, Andorra presents a somewhat more rigorous process to become a tax resident, whether you are a nomad, an active resident, or a passive one.

However, don’t lose sight of the fact that this digital nomad visa also offers attractive benefits that may be of interest to you:

- The digital nomad avoids the €50,000 deposit required by Andorra’s financial authority.

- There is no need to establish a company to obtain tax residency.

- There is no obligation to contribute to the CASS (social security), though life insurance is required. The minimum stay requirement, as per Andorran regulations, is 90 days.

The digital nomad can obtain tax residency in Andorra if they meet the requirements established by the IRPF law.

Conclusion

As we’ve seen, Andorra offers numerous options. Each option has its specific requirements and advantages, making Andorra an attractive destination for those looking to optimize their tax burden and quality of life.

If you want to know if Andorra is the best destination for you or if another European country is a better fit, don’t hesitate to contact us for a consultation to provide you with the best information on the matter. You can contact us HERE

Frequently Asked Questions

- How long does it take to obtain residency in Andorra? The time varies depending on the type of residency you choose. For Active Residency, the process of registering a company and obtaining residency can take around 12 weeks. In the case of Passive Residency, once the required investment is made, you can obtain tax residency in Andorra after 90 days of residence.

- Can I open a company in Andorra as a foreigner? Yes, as a foreigner, you can open a company in Andorra, allowing you to opt for Active Residency. However, it’s important to meet the established requirements and demonstrate that the company will engage in genuine business activity in the country.

- Can I be a digital nomad in Andorra without opening a company? Yes, with the new Digital Nomad Visa in Andorra, there’s no need to open a company. You can work remotely if you meet the requirements, which provides you with the opportunity to reside in the country without the need to invest large sums of money.

- What taxes do I have to pay in Andorra? Andorra has an attractive tax system. The main taxes include Personal Income Tax (IRPF) and General Indirect Tax (IGI). IRPF has low rates, with a maximum of 10% for salaries exceeding €40,000. IGI is an equivalent to VAT, with a general rate of 4.5%. In addition, Corporate Tax has a maximum of 10%, making it one of the lowest in Europe.

- What are the requirements for the Digital Nomad Visa in Andorra? The requirements for the Digital Nomad Visa include working remotely using information and communication technologies, having no criminal record, having financial means to support yourself during your stay, having a physical address in Andorra (rented or owned), and having health insurance.

- Is Andorra a safe country to live in? Yes, Andorra is considered a safe country with a low crime rate. It offers a peaceful and stable environment, making it attractive to those seeking security and quality of life.

- Can I apply for permanent residency in Andorra? Yes, once you obtain residency in Andorra, you can apply for permanent residency after a specified period of legal residence in the country. Specific requirements may vary depending on the type of residency you have obtained.

Feel free to visit our YouTube channel for more information about Andorra and other European countries: HERE