If you are looking for living in Thailand, you should know that last year, Thailand made a shocking announcement: the tax system that attracted nomads who wanted to pay 0% tax on their income legally has been abolished. So let’s see how it works in 2024. Is it still possible to pay zero percent tax? The short answer is yes, it is still possible.

If you want to know the future, look at the past. Thailand is the only country in Southeast Asia that was never conquered or colonized by any European country. It always had a unique culture, traditions, laws, and of course, taxes.

The “Land of Smiles,” which is the usual nickname for this country, as people do smile a lot there, is part of Thai culture and traditions. With its beautiful nature and cheap prices, Thailand has always been an attractive destination not only for vacations but also for relocation and residence for nomads.

Indice del artículo

Tax Residency in Thailand

Anyone who spends 180 days or more in Thailand is considered a tax resident and automatically has the obligation to pay taxes there. The law has always clearly stated that all tax residents have to pay taxes on any income sourced from Thailand, meaning income earned from the territory of Thailand or sourced from abroad. Therefore, all income must be taxed according to the law.

However, in 1987, Thailand adopted a tax ruling. To simplify, a tax ruling is a clarification of how exactly the tax laws will be applied. And it was this 1987 tax ruling that said any income remitted (i.e., transferred or brought) to Thailand in the same year when it was earned is subject to taxes.

So, what did all the foreigners, as well as many Thai people, do? They earned income, did not bring it to Thailand immediately, and as a result, did not pay taxes on it. For example, if you earned income in 2023 and transferred it in 2024, then it was not subject to taxes.

At the end of 2023, this tax ruling that allowed earning an income in one year and bringing it to Thailand the next year tax-free was abolished with the effective date starting from January 1, 2024.

Current Tax System in Thailand

What do we have in Thailand now? Any income earned and sourced from Thailand is still taxed, this has not changed. What changes is that any income you bring to Thailand, regardless of when you earned it and for what purpose you are transferring it to Thailand, whether to pay rent, hospital bills, or any other purpose, is always taxed as long as it is income.

Generally, most income and gains you have are subject to taxes. There are only a couple of categories that might be taxed in some countries but are not subject to taxes in Thailand. For example, social benefits are taxed in several countries; however, they are not included in the definition of “income” according to Thai laws, so you will not pay taxes on them in Thailand even if remitted there.

Why did this amendment have such a big impact and is so widely discussed by all tax experts, companies like ours that help people relocate? Simply because from 1987 until the end of 2023, foreigners did not pay taxes in Thailand.

Everyone was used to the notion that Thailand is a cheap country with good nature, lots of expats, where you can live freely, legally, and pay zero percent taxes. And when a change was announced, of course, plenty of schemes and advice were provided by “experts.”

So, what taxes will you pay if you relocate to Thailand?

Generally, migration laws and tax laws are not connected at all. There is a strict division between these two fields. If you live legally in the country, meeting certain criteria, you have to pay taxes regardless of your migration status: temporary, permanent resident, or even a citizen. Only a few countries offer different tax options for different migration categories, and Thailand is one of them.

Visa for Living in Thailand

Let’s start with the most privileged category: expats moving with the LTR visa.

LTR Visa in Thailand

The LTR visa is a long-term residency visa, issued for 10 years. First, you apply for 5 years of residency, and after this, you can extend it for another 5 years. The main benefit is not even long-term residency but being completely tax-free for any foreign-sourced income remitted to Thailand. So whatever amount you transfer to Thailand will always be tax-free. Many people say, perfect, then why would I pay taxes and apply for the other visa category if I have this option?

The answer is simple. Thailand has a very cautious approach towards foreigners. The most obvious example of this is real estate. Foreigners cannot own land in Thailand. What can be owned is a condo, which is basically an apartment. But if you want to own a villa, townhouse, or just a piece of land, you cannot do that legally. Ownership can only be transferred to a Thai citizen.

Of course, schemes always exist to overcome this. Some register a company in Thailand with a Thai citizen who owns at least 51% of the shares and then transfer such a house or piece of land in the name of the company. This is always a risky move as in this case the house is not fully yours.

So as you see, foreigners are not prohibited from relocating, working, and living in Thailand as the country needs investments for the economy and development of the country. But the government wants to change the image of Thailand from a “cheap and very affordable country” to a country for highly skilled and wealthy expats, and because of that, not everyone can relocate to Thailand and only a few can get the tax exemption.

Categories of LTR Visa in Thailand

The LTR visa is the best example of this. It was introduced only in 2022 and is available to 4 categories of people:

- Wealthy global citizens

- Wealthy pensioners

- Remote workers

- High-skilled professionals

The first two categories are only for people with passive income. Wealthy global citizens among other requirements must possess at least USD 1 million, have USD 80,000 yearly income, and invest USD 500,000 in Thailand.

The wealthy pensioner visa is available if you are older than 50 years and have either a passive income of USD 80,000 or less than 80 but over USD 40,000 and made an investment over USD 250,000 in Thailand.

Remote workers, or the official name is “work from Thailand professionals,” is suitable for employees with an income over USD 80,000 or less than 80 but over USD 40,000 who either have a master’s degree in their field or an IP asset in their name. Work can only be performed for a public company, meaning one that is traded, or for a private company that earned at least USD 150 million in the last 3 years.

And the last category eligible to apply for an LTR visa are high-skilled professionals. You need to earn above USD 80,000. If the income is smaller than 80 but over USD 40,000, you also need to prove your qualifications, as well as be employed only in the special predetermined fields being developed by the government.

Benefits of the LTR Visa in Thailand

So, only people who relocate to Thailand with those visas have special tax treatment: foreign income is tax-free and income originating in Thailand as a highly qualified professional is taxed at the reduced rate which is a maximum of 17%.

There are several benefits of the LTR visa, but the main and most significant one is, of course, the tax treatment. Any other visa requires you to pay taxes in Thailand while spending at least 180 days there.

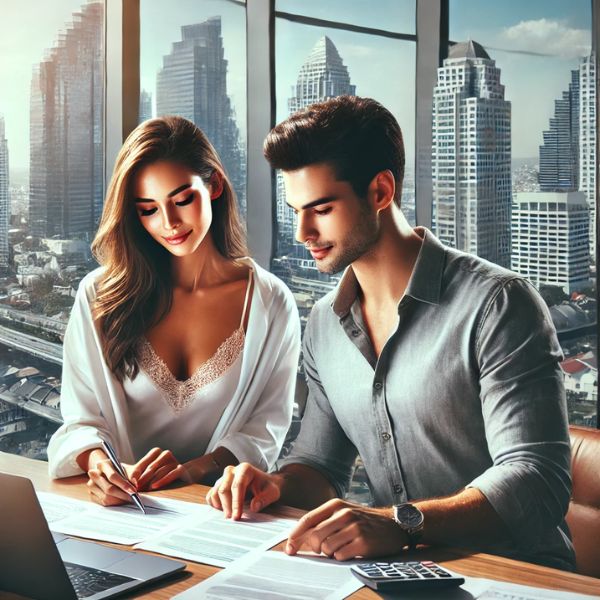

Tricks to Live in Thailand Without Paying Taxes (Low Money)

One of the main issues that arise in Thailand as well for any digital nomad, entrepreneur, is how to legally work from there. Of course, some prefer having a US LLC (open a US LLC by clicking here), physically residing in Thailand under some visa type that doesn’t allow working from Thailand but simply not declaring the income.

But, how can you later transfer the money to any bank account? It is not dividends. Most banks, especially in Europe, would require confirmation of how you acquired the funds and whether you paid taxes.

Trick No. 1: Find a Sponsor in Thailand

An individual who lives in Thailand finds an employer of record, who acts as a sponsor for a work permit. The employer of record becomes the supplier of the US LLC. The employer of record pays you a salary, as well as taxes and social contributions.

As a result, part of the income of the US LLC you receive as a salary, pay taxes in Thailand, and can get a tax residency certificate. The money you did not bring to Thailand will be tax-free as they are not remitted to Thailand.

This is an example of one of the solutions people use when residing in Thailand with a visa that allows them to stay there but does not permit them to work from the territory of Thailand. For example, if you are staying with the Elite visa in Thailand.

Other Tricks for Not Paying Taxes in Thailand

In any case, even if you have a permit to work but do not feel like paying taxes, I found plenty of advice on the internet on how to do it. However, I presume most of them were not given by lawyers or professional tax specialists. So here are some of them:

- Buy yourself real estate in Thailand. As I mentioned before, you cannot buy a house but you can buy a condo. However, buy it not with your own money but take a mortgage from a foreign bank. The foreign bank has to give you a loan in Thailand. A loan is not an income, so it is not subject to taxes in Thailand. With your foreign income, pay back the mortgage. In this case, there is no remittance to Thailand and thus no tax.

- A person who lives in Thailand can have a gift from a person living abroad. Thus, it is not an income per se.

- If you do not need to have real estate, take a loan from a foreign bank or a loan from some of your relatives. For example, a loan from a relative who lives in Spain. They send you 100K to Thailand, it is not an income. You pay back the loan with the money that is earned abroad.

The Definition of Remittance in Thailand

Are those “tax tricks” allowed? No, they are neither allowed nor prohibited. But the application, the definition of remittance is new. Although the law itself has existed for decades, most people were not remitting income to Thailand in the same year, so everything was clear. However, the wording of the law does not necessarily imply that it should be applied strictly as written.

In legal science, there are definitions like “The Spirit of the Law” and the “Letter of the Law.” So, what the people who gave those advices did was to analyze only the “Letter of the Law,” just the wording, what is exactly written in the law.

The spirit of the law defines the purpose the government had when adopting a certain law. And the purpose of making legal amendments about what should be taxed in Thailand is: To have taxes on any income. In the previous examples, taking a loan is not a final purpose, but just a means, a way to avoid paying taxes. Of course, there should be an official clarification on how it will be treated, but we assume it will not work, you cannot avoid paying taxes in the ways described above.

Other Countries that Tax Based on Remittance

In most countries that also tax based on remittance, for example, with the UK’s Non-Dom, which will be abolished next year, there are very detailed definitions of what income should be taxed in the case of remittance.

If Thailand decides to make an efficient form in terms of time, costs, and resources to create the clarifications, most of the practical application of remittance-based taxation will be copied from other countries. To be honest, when legislation is changed, that is what happens in most cases. Some countries, when making amendments to their legislation, even officially invite experts from other countries so they can help them “copy” the legislation from the other country.

Would These Tricks Work to Legally Avoid Paying Taxes?

So Thailand can do the same. In the United Kingdom, a loan you receive from abroad is not taxed. However, the repayment, as well as any interest paid on the loan amount, is considered taxable income. In the end, the loan is, for example, 100 thousand, along with the interest rate you have to pay the bank 150 thousand, then you have to pay taxes on 150 thousand.

The “tax trick” of receiving a gift from a relative? Again, it’s not that simple. A gift means you will never repay the money and the person who gave you the gift will have no benefit at all.

Another example is using a credit card from a foreign bank. But again it is a loan and it is most likely to be taxed in the end.

In the same way that if you are withdrawing cash from an ATM in Thailand or even abroad, banks will automatically notify the Thai tax authorities about this, due to CRS (read this blog). The only country that does not send such notification is the USA, as it is not part of the CRS system, but of FATCA.

However, can you be sure that the USA will never share your information with another country? Definitely not. There is now a possible exchange of information with Argentina. So other countries may claim this exchange as well.

Nonetheless, if you want to relocate to Thailand or another country, you can always book a call with us and have a detailed analysis of your own case.