Friends, today we will open the chest of authoritarianism and control in the West with a rawness that hurts, because the truth is, the more truth, the more it hurts. The world is changing rapidly, and today I will talk about how Western governments seek to control us, but we will also discuss solutions, as always. Today, we will talk about the best options for becoming a tax exile in a low-tax country.

Indice del artículo

The Problem of Being Spanish (or European): Why Do We Consider Tax Exile?

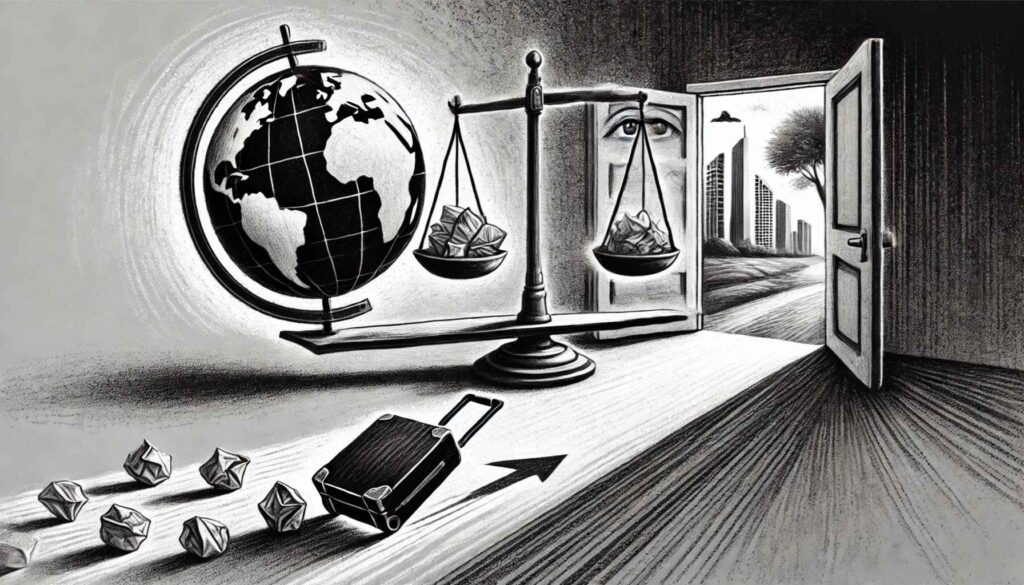

We find ourselves at a crossroads, where technology promises wonders, but at a price that few seem willing to acknowledge: our own freedom. CBDCs, digital IDs… I don’t know if these terms ring a bell for you, but they resonate with the promise of a “safer” tomorrow, yet they are nothing more than golden chains in a digital prison that we are building brick by brick.

Let’s speak frankly, answer yourself honestly: Since when have we let ourselves be controlled? Since when is the price of feeling “safe” walking naked, without privacy, under the watchful eyes of our rulers? This is not a matter of paranoia; it is the harsh reality of our present, a mirage of freedom where every step, every word, every sigh is recorded and categorized.

We have reached a point of no return. They deceive us into believing that everything is for our own good, that we will live better in a world where our lives are an open book for those in power. But what kind of life is that? One where every move is predetermined, every choice is supervised, every desire is known?

Comparing authoritarianism and control in the West with previous times

To make you aware of the consequences of the authoritarian policies being imposed on us, I want to talk to you about the Great Leap Forward in China, led by Mao Zedong between 1958 and 1962. An example of how control measures, imposed under the promise of well-being and progress for the population, almost always end up resulting in massive and disastrous control of society, with devastating consequences.

Mao Zedong, seeking to transform China from an agrarian economy into an industrialized socialist society, pushed forward the Great Leap Forward. The vision was noble on paper: to accelerate agricultural and industrial production to catapult China into the future, reducing the gap with Western powers.

To achieve this, Mao promoted the creation of people’s communes, grouping families into collective units that lived, worked, and ate together. Land, animals, and agricultural tools were collectivized, eliminating private property.

However, the reality was very different and much darker. Production goals were unrealistically high, based on inflated statistics and the denial of reports about difficulties and failures. The pressure to meet these goals led to the implementation of untested agricultural techniques and disastrous decisions, such as the “Four Pests Campaign,” which aimed to eliminate rats, flies, mosquitoes, and sparrows, the latter being particularly catastrophic for crops.

The result was one of the worst famines in history, where millions of people lost their lives due to lack of food. The famine was exacerbated by the grain quota system, where communes were required to deliver unattainable amounts of grain to the state, leaving the communes without enough to feed themselves. Fear and repression silenced critics and those who tried to report the truth, while the country continued to export grain to maintain the image of success in the eyes of the world.

The Best Countries to be a Tax Exile

Comrade, if this story has impacted you and you believe that our governments are leading us to our misery, then now is the time to shake off the dust and look to the future with critical eyes. We are not here to be mere spectators of our own lives, but to take the reins, to decide what kind of world we want. And for that, today I present to you the list of tax havens proposed by the Heritage Foundation (you can see the complete list here), an index that ranks the most liberal economies on the planet. We will focus on those countries that, besides being liberal, have low taxes and compare them with Spain…

Let’s review it to identify which countries might be interesting for becoming a tax exile. Considering that my audience encompasses various profiles, in upcoming blogs on our website, we’ll discuss these countries one by one.

If you look at the heading of the list, you’ll notice that this index focuses on aspects such as economic freedom, individual autonomy versus social norms, market economy, government, etc. Let’s start with Spain, which ranks 55th in terms of fiscal freedom.

In Spain, although property rights are highly rated, it’s evident that the creator of this list hasn’t considered the squatting problem (many are tax exiles from other countries 🙂 in our beloved country; otherwise, we’d be much lower in the ranking, perhaps even at 100th place.

Regarding judicial effectiveness, Spain scores 64 out of 100 (on a scale where 0 is the worst and 100 is excellent), while in government integrity, it reaches 57. In terms of tax burden, it barely reaches 26, which is truly concerning due to the high expenses the country generates, coupled with stifling tax policies that strangle the economy.

As for government expenses, it’s noteworthy that Spain scores 0.0 out of 100, suggesting that the public administration in Spain is a bottomless pit…

Anyway, the rest of the indicators like fiscal health, labor freedom, and investment freedom exceed 70… but let’s see other countries that might interest us as entrepreneurs or digital investors in search of that paradise where we can have greater economic freedom and therefore invest in a country with better prospects to become a tax exile.

Where to choose your destination to be a true tax exile?

If we head to the 52nd place, we find Panama, a good country to be a tax exile. When observing property rights, we notice they score lower than in Spain, which is surprising considering the respect given to property in Spain despite squatters, but oh well, what can we do. As for political stability, it also scores lower than in Spain, suggesting that, without the support of Europe, the situation could be very different in Spain.

However, in terms of tax burden, Panama stands out with an impressive score of 82 out of 100. This is remarkably high for an economy characterized by its focus on investment and assets, unlike what Spain offers, where prosperity seems reserved for those working for the administration, leaving others in a situation of tax exile.

Regarding government expenses, Panama also has a very good score of 82 out of 100, unlike Spain’s 0…

And friends, just like Panama, other countries like Malaysia or Costa Rica (amazing for tax exile) where part of the income generated abroad is tax-free, are in a better ranking situation than Spain… for example, Malaysia, a Muslim country and developing, ranks 45th in economic freedom for tax exiles.

TOP 10 countries to be a tax exile

Other countries like Romania or Cyprus, where you also have greater economic freedom than Spain, are characterized by low taxes and lower government expenses… Why is that? well, let’s go to the top 10 and see what we can find…

If we look for economic freedom, we see 3 giants in the list to become tax exiles: Singapore, Switzerland, and Ireland… Then, in lower positions in the top 20, we find the United Arab Emirates or Uruguay.

Let’s look at Singapore, Switzerland, and Ireland, which occupy prominent positions in the Economic Freedom Index due to their combination of market-friendly policies, efficient and transparent legal systems, and regulatory environments that promote entrepreneurship.

Tax exiles coming to these countries have implemented competitive tax regimes that attract foreign investment and foster innovation. Additionally, they have robust financial infrastructures and open foreign trade policies, facilitating trade and international investment. This combination of factors ultimately creates an environment conducive to economic growth and prosperity.

And friends, let me ask you a question, isn’t it time for us to start considering our future in these countries?