What will you gain from our planning?

At Nomad Tax we help you take control of your taxation with customized strategies that optimize your taxes, protect your assets and ensure your legal peace of mind. We design tailor-made solutions for those who operate in a globalized world, adapting to your needs and objectives.

Regulatory compliance

We help you comply with international regulations without complications.

Customer Financial Privacy

We guarantee maximum confidentiality in your international operations.

Tax Optimization

We design strategies to minimize your tax burden in a completely legal way.

Asset protection International

Safeguard your assets against unnecessary risks with secure financial structures.

International Flexibility

We design plans that fit your lifestyle and your overall income to ensure your success.

Results Guarantee

We are committed to offering effective solutions tailored to your specific needs. If we cannot help you, we will not accept you as a client.

How Does Our Consulting Work in 4 Simple Steps?

With our four-step process, you’ll have clarity and control at every stage. From understanding your needs to implementing customized strategies, we guide you to optimize your taxation and protect your assets in a simple and efficient way.

Initial Consultation

Are you clear about your objective? Write us directly by WhatsApp (number below) and tell us your case. Our team will evaluate your needs and suggest the best personalized plan for you.

Make an appointment

Already know what you need? Go to the consulting section in the calendar below, choose the model that best suits your objectives and schedule a consultation with our specialized legal team.

Customized analysis

Complete our form with your details and relevant information. Our legal team will carefully review your situation to prepare the best solutions adapted to your case.

Strategic meeting

During a video call with our team, you will receive a clear and detailed plan that optimizes your taxation and protects your assets.

Implementation of solutions

With the strategy defined, we help you implement it step by step to ensure that everything is tied together and meets your objectives.

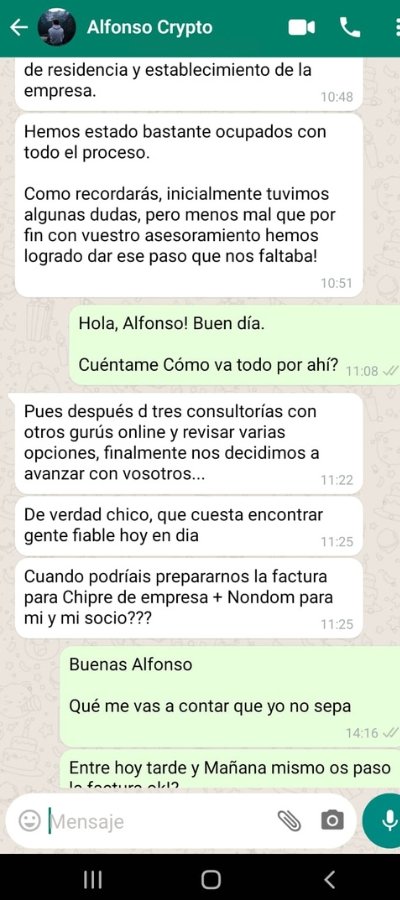

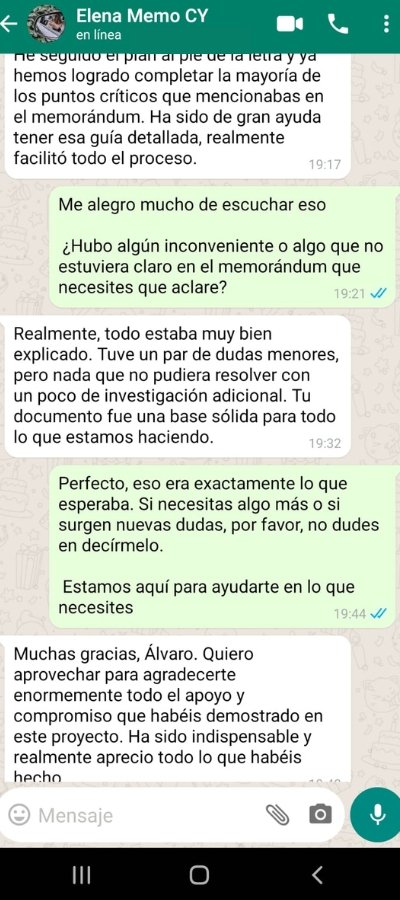

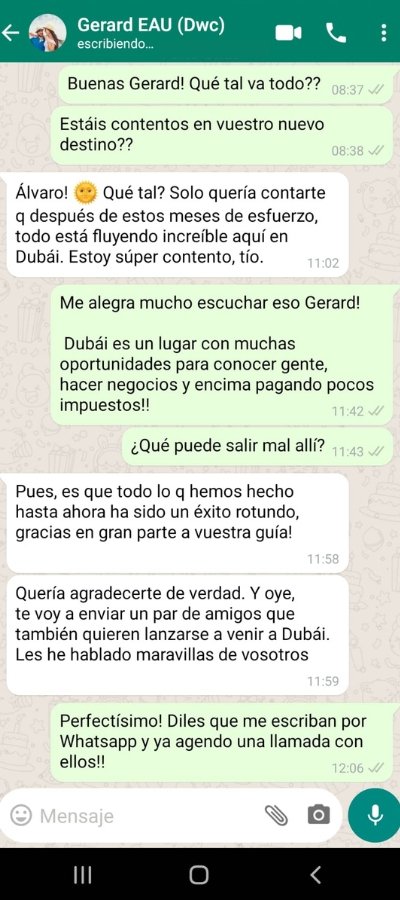

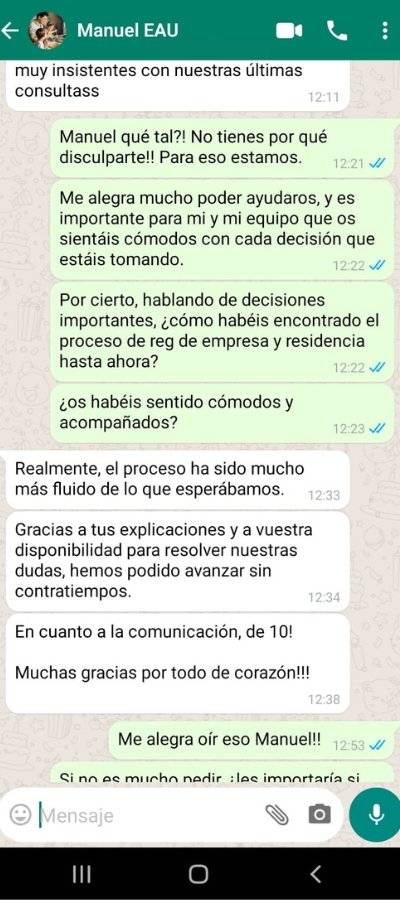

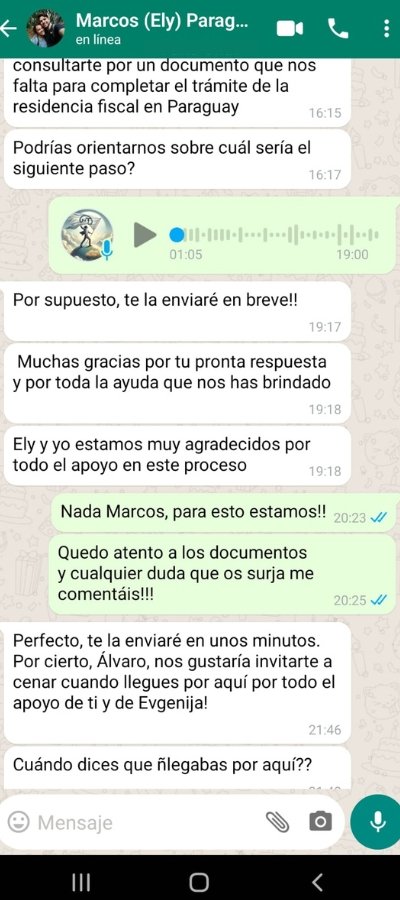

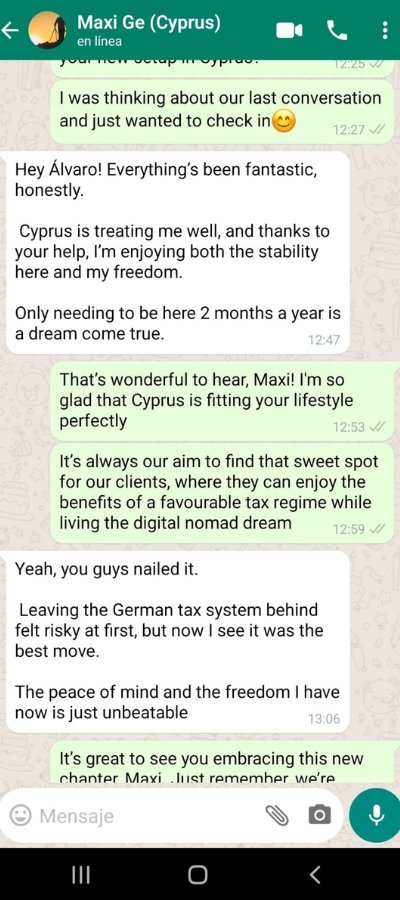

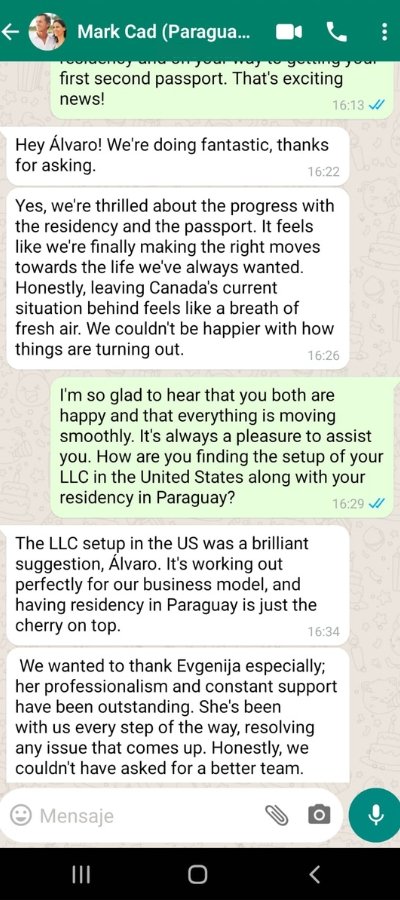

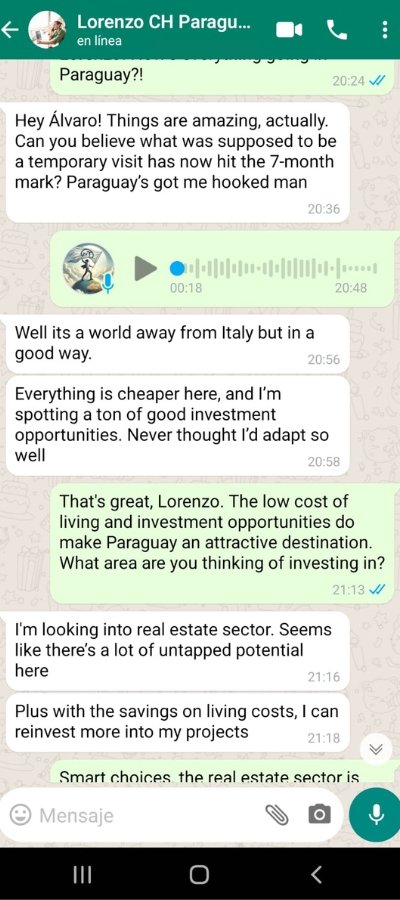

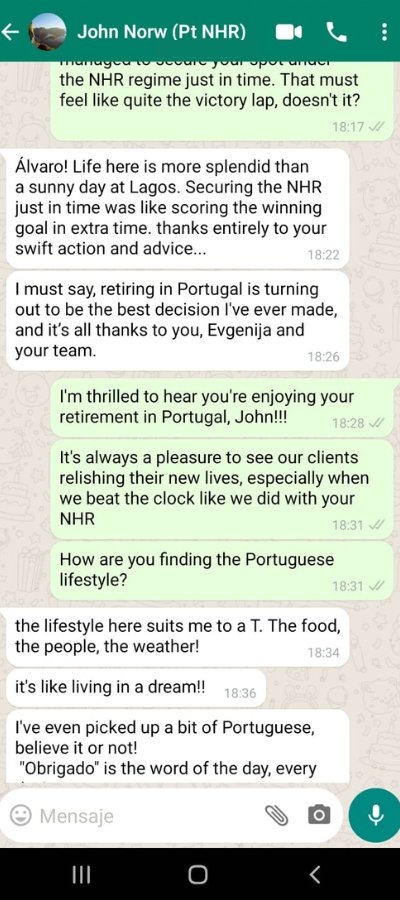

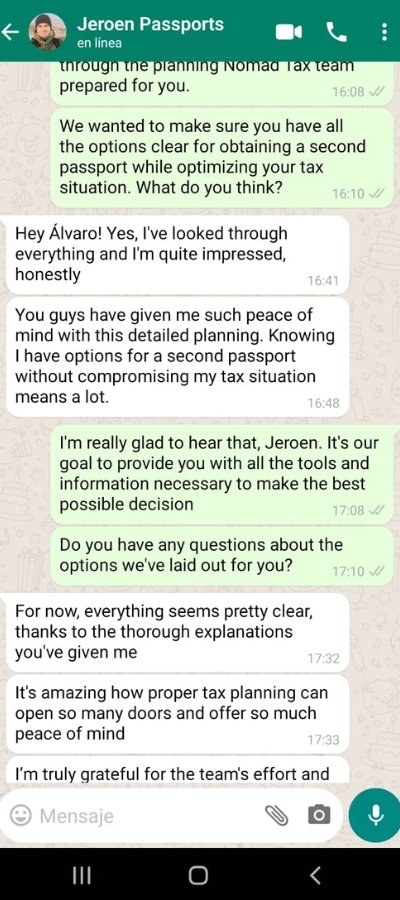

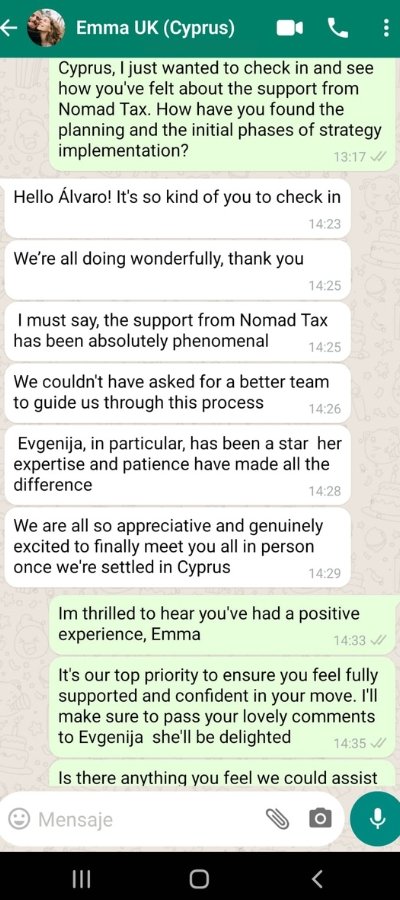

Success Stories: Clients Who Transformed Their Lives

Discover how our clients have optimized their taxes, protected their assets and achieved financial freedom thanks to our customized international tax consulting solutions.

Flexible Plans to Optimize your Taxation

Choose the plan that best suits your needs. We offer customized options to help you reduce taxes, protect your assets and comply with international regulations.

Consulting

Analysis to the point for those who are clear-

Detailed analysis: Pros & Cons

-

Analysis of tax benefits at source and in multiple countries

-

Identification of risks and disadvantages of each strategy

-

Indicative quantitative analysis

-

Communication and presentation of the consultation

-

Gathering of information by means of a previous form

-

60 minutes of video call with the customer

-

Second call for an extra 30 minutes

-

Resolution of doubts Post consultation: 2 mails

-

Post consultation process

-

Details of the concrete steps for strategy execution

-

Customized budget to implement strategy

VIP Consulting

Analysis and support in one pack-

Detailed analysis: Pros & Cons

-

Analysis of tax benefits at source and in multiple countries

-

Identification of risks and disadvantages of each strategy

-

Indicative quantitative analysis

-

Communication and presentation of the consultation

-

Gathering of information by means of a previous form

-

60 minutes of video call with the customer

-

Second call for an extra 30 minutes

-

Resolution of doubts Post consultation: 2 mails

-

Post consultation process

-

Details of the concrete steps for strategy execution

-

Customized budget to implement strategy

Do you have any doubts?

Once we receive your data and have evaluated it, we will provide you with an appointment. In some cases we may have to modify your date if we need a specific specialist.

We will send you a form in which we will evaluate your profile as a client. If your profile is not compatible with our criteria, we will refund your money and we won’t be able to continue working together.

You can pay by credit card and by bank transfer. We also accept Bitcoin and USDT

Yes, you are welcome to include anyone who’s part of your decision-making process in the call. However, recording of the calls is strictly prohibited by the policy of Nomad Tax.

No. We are not tax advisors and do not provide legal or tax advice. In the strategy call a tax lawyer might be present if our team would consider it necessary based on the information you provide to us before the strategy call and is solely at the discretion of Nomad Tax.