Surely, if you are considering moving to another country to reduce your taxes, you have come across the typical comment among friends or acquaintances that says, “You’re very unfair, you should stay in your country and contribute with taxes. Do you think roads build themselves? Is healthcare free?”

At Nomad Tax, we believe that everyone can do whatever they want with their money, especially because we are aware that Western states have ceased to manage the funds collected from taxpayers prudently and efficiently.

Who likes to finance politicians’ dinners with the money they worked hard to earn? Why should you sustain an inefficient administration and absurd political salaries when you could live in a country with an equal or better quality of life without paying taxes?

Nomads, today we head to the United Arab Emirates, the country of luxury and opulence. Here, nothing is mediocre; they offer one of the best services, excellent healthcare, beautiful beaches, sunshine, and, of course, many opportunities to establish new business connections. let’s check this Dubai Tax Residency requirements Guide

Is it really necessary to pay high taxes to enjoy a great quality of life? Isn’t it?

It is true that, since the introduction of the new corporate tax earlier this year, some business owners decided to move their companies to other jurisdictions, but most stayed.

Why? Because the UAE still has many benefits. However, the UAE is a very complex jurisdiction. It is important that before moving here, you understand how everything works in this area since many make mistakes when relocating their tax residence here.

Indice del artículo

Key Considerations When Obtaining Your Tax Residency in Dubai

Its legal system is based on civil law principles scattered across federal laws and laws of the 7 emirates applied to non-federal matters, with free zone regulations applied within the jurisdictions of these free zones. This includes principles of English common law applied in some financial free zones, and Sharia law primarily applies to personal status matters, such as family and inheritance relationships.

The UAE has a diverse network of double taxation treaties with nearly 140 countries. The Federal Tax Authority of the UAE issues tax residence certificates to companies incorporated in the UAE and to individuals who are residents in the UAE. Why is this important? Because if you cannot present the tax residence certificate, in some cases, it could lead to negative consequences, as your country may continue to consider you as its tax resident.

Dubai Tax Residency Requirements for 2024

On February 22, 2023, the Ministry of Finance of the United Arab Emirates issued Ministerial Decision No. 27 of 2023 on the Implementation of Certain Provisions of Cabinet Decision No. 85 of 2022 on the Determination of Tax Residency. This new decision provides additional details on the requirements for an individual to qualify as a tax resident in the United Arab Emirates.

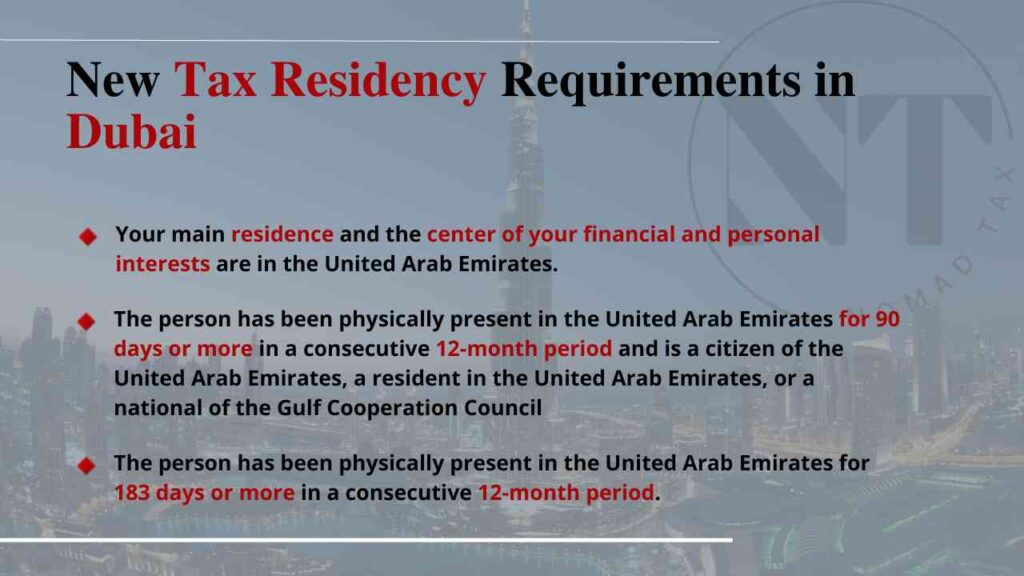

According to Cabinet Resolution No. 85, as of March 1, 2023, individuals can be considered tax residents in the United Arab Emirates if they meet any of the following conditions:

- Their main place of residence and the center of their financial and personal interests are in the United Arab Emirates.

- The person has been physically present in the United Arab Emirates for 90 days or more in a consecutive 12-month period and is a citizen of the United Arab Emirates, a resident in the United Arab Emirates, or a national of the Gulf Cooperation Council (GCC) who has a permanent residence in the United Arab Emirates or engages in work or business in the United Arab Emirates.

- The person has been physically present in the United Arab Emirates for 183 days or more in a consecutive 12-month period.

If a tax treaty establishes specific conditions for eligibility for tax residency, Cabinet Resolution No. 85 of 2022 specifies that the provisions of the tax treaty will apply for the purpose of applying the tax treaty.

Additional details on the conditions for determining the tax residence of natural persons

Ministerial Decision No. 27 of 2023 provides further clarification on each of the conditions mentioned earlier.

- Individuals whose main place of residence and center of financial and personal interests are in the United Arab Emirates (regardless of the number of days spent in the United Arab Emirates).

To meet this condition, all of the following requirements must be satisfied:

- The main place of residence must be in the United Arab Emirates, where the individual resides habitually or normally. This is the place where they spend the majority of their time compared to any other jurisdiction as part of their established routine in a way that goes beyond the transient.

- The center of financial and personal interests must be in the United Arab Emirates, meaning that personal and economic interests are closer or of greater importance to the individual. Consideration should be given to occupation, family and social relationships, cultural activities or others, the place of business, the location from which the individual’s property is managed, and any other relevant facts or circumstances.

2. Individuals who have been physically present in the United Arab Emirates for 90 days or more in a consecutive 12-month period and are citizens of the United Arab Emirates, residents in the United Arab Emirates, or nationals of the Gulf Cooperation Council (GCC) who have a permanent residence in the United Arab Emirates or engage in work or business in the United Arab Emirates.

To meet this condition, the following requirements must be fulfilled:

- Individuals must submit an entry and exit report from the Federal Authority for Identity and Citizenship or a competent local government entity confirming the number of days spent in the United Arab Emirates.

- And one of the following documents:

- Proof of a permanent source of income or a salary certificate or other evidence of conducting business in the United Arab Emirates.

- Or proof of a permanent residence, such as a property deed or certified lease agreement (EJARI) or another long-term lease contract. Utility bills will also be helpful.

3. Individuals who spend 183 days or more in the United Arab Emirates.

- Individuals must submit an entry and exit report from the Federal Authority for Identity and Citizenship or a competent local government entity.

Additional clarifications: The new Ministerial Decision also clarifies that all days or parts of a day in which an individual is physically present in the United Arab Emirates will be counted as days in the United Arab Emirates.

The days do not need to be consecutive to determine the period of 183 days or 90 days. However, the authorities may ignore any day spent in the United Arab Emirates due to exceptional circumstances.

An exceptional circumstance is considered an event beyond the control of the individual that occurs while they are already in the United Arab Emirates, which they could not have foreseen and that prevents them from leaving the United Arab Emirates as initially planned.

Application Process for Tax Residency Certificates (TRC) in Dubai

Individuals can submit their applications for tax residency certificates online through the portal of the Federal Tax Authority.

When applying for a TRC for internal tax purposes, individuals must choose one of the three options related to the conditions mentioned above and upload the corresponding required documents.

Implications: Individuals and businesses must review the conditions to determine tax residency in the United Arab Emirates to establish if any of the conditions apply to them or their employees, respectively. If applicable, it should be verified whether such individuals can meet the relevant requirements under the applicable condition.

Attention should also be paid to the days when an individual is considered physically present in the United Arab Emirates, especially upon arrival or departure from the United Arab Emirates.

New Tax Changes in Dubai

Until now, Dubai had been famous for not imposing income or corporate taxes. However, recent signals indicate changes in the tax landscape. There is speculation about the potential expansion of the corporate tax, which could also encompass employees’ income in the next three years.

This evolution is not surprising; global tax history has shown that once a tax administration is established, taxes tend to multiply. Let’s recall the introduction of the 5% Value Added Tax (VAT) in 2018 as a clear example of this pattern.

The introduction of a 9% corporate tax has puzzled many, as it not only affects corporate entities but also income from commercial activities for individuals. In this new scenario, even freelancers must pay taxes similar to large corporations.

Now, the good news: the UAE offers an exemption of 375,000 AED (100,000 $) for small businesses and freelancers, a figure that, in practice, could be double. Additionally, salaries and capital gains will remain tax-free, providing some relief.

For investors, there is good news: the UAE maintains exemptions on capital gains and dividends, facilitating withholding tax strategies through international agreements. Obtaining tax residency has also been simplified, offering additional advantages.

However, these transformations will not only impact local and foreign businesses but also those who own overseas companies. The effective management rule will be implemented, following international standards, and uncertainty surrounds its exact application.

Key recommendation: if you reside in the UAE and own overseas businesses, consider adjusting your position in the commercial registers to avoid unwanted tax implications. Nevertheless, indirect implications should also be considered. Even though you can avoid the corporate tax, you will need to focus on maintaining solid accounting and filing local tax returns.

With free zones now requiring accounting even for inactive companies, fiscal transparency increases, affecting even companies with no actual activity. While dividends remain exempt, an increase in accounting supervision is expected.

You know that as Dubai evolves in its tax landscape, it is essential to stay informed about the latest regulations. Careful planning and adaptability will be crucial in this fiscal journey.

What zone to choose when setting up a company in Dubai?

Before telling you, let me invite you to subscribe and like our video; we deserve it by bringing you high-quality content.

Well, there are basically three main structuring options available for foreign investors looking to launch business activities in the UAE:

- Establish a local company in the territory of the UAE.

- Set up an entity in one of the free zones of the UAE.

- Incorporate an offshore company in selected free zones of the UAE.

So be careful; establishing a company in a free zone does not mean it is considered a company in the territory, so you may not benefit from double taxation treaties. That’s why it is extremely important to understand which free zone you need: they are all called free zones, but you could end up being taxed twice.

Each free zone has specific corporate regulations applicable only in that free zone. There are more than 50 free zones in the Emirate of Dubai and in other emirates. Most free zones are based on themes (e.g., Media Free Zone, Dubai Healthcare City, etc.) with licensed activities limited to a specific field.

Some free zones offer a broader scope of licensed activities. Two financial free zones operate under the framework of English common law.

The choice of a free zone is mainly determined by the planned activity and its scope, but also by other factors such as supported licensing activities, the location of the free zone, infrastructure, incorporation and maintenance costs, and possibilities of opening a bank account.

As mentioned earlier, starting from June 1, 2023, the UAE has introduced corporate tax. However, any income below AED 375,000 (about 100,000 dollars) is taxed at 0%, and income above is taxed at a rate of 9%. Income tax in Dubai for foreigners will be taxed at 0% on an individual level. If you are a freelancer, you will still be subject to a 9% tax.

If you want us to tell you which is the best free zone for your business, don’t hesitate to schedule a consultation with us.

Bank Accounts in Dubai, Is It Really a Problem?

Another concern that many entrepreneurs have is banking. However, in reality, it won’t be a problem if you do everything correctly and choose the right free zone.

But well, we will talk about all of this in an article dedicated exclusively to banks in Dubai because it will require a complex and in-depth study.

I hope this information has been helpful. So, keep thinking about what you can do to minimize your taxes and maximize your wealth, and remember, we are just a call away if you need us to evaluate your personal case.

Frequently Asked Questions

- What is the legal system in Dubai and how does it affect tax residency? The legal system in Dubai is based on principles of civil law, federal laws, and laws of the 7 emirates, with specific regulations for free zones. Sharia law applies to personal matters. This has implications for tax residency, as different jurisdictions apply different regulations.

- How do double taxation treaties in Dubai affect tax residency? The UAE has an extensive network of double taxation treaties with almost 140 countries. The Federal Tax Authority issues tax residency certificates, crucial to avoid negative consequences in other countries that might consider you a tax resident.

- What are the new requirements for Tax Residency in Dubai from 2023? From February 22, 2023, new requirements have been introduced. Individuals can be considered tax residents if they meet conditions such as having their principal residence and center of financial interests in Dubai or having spent a certain amount of time physically present in the country.

- What additional clarifications are provided by Ministerial Decision No. 27 of 2023? The ministerial decision provides specific details for each condition, such as the requirement that the principal place of residence is in Dubai and the center of financial and personal interests is in the country. It also establishes the necessary documentation for those who have spent 90 or 183 days in Dubai.

- How do tax changes in Dubai affect companies and those with businesses abroad? Dubai, known for not imposing income or corporate taxes, is undergoing changes. The introduction of a 9% corporate tax has raised concerns. Companies, even foreign ones, should consider adjusting their position in the commercial registers to avoid potential tax complications.

- How does the choice of free zone affect taxation in Dubai? The choice of the free zone is crucial for taxation. Over 50 free zones in Dubai offer specific regulations. Some free zones apply English common law. As of June 2023, a 9% corporate tax has been introduced, but income below AED 375,000 is taxed at 0%.

- Is it complicated to open bank accounts in Dubai for foreign companies? Not necessarily. Choosing the right free zone is key, and a proper approach facilitates the process. However, this topic will be explored more deeply in a specific article dedicated to banks in Dubai.

If you want more information, you can find us on our Youtube channel.