If you’re considering whether to change tax residency in 2024, you need to know that at this historical moment, adapting is not an option, it’s a necessity. Some major economies are staggering, and in other places, like Spain, besides staggering, they hit you with taxes for every breath you take.

Staying in a country with no future could be signing your own stagnation sentence. That’s why you might be toying with the idea of moving to a country with a broader horizon, and on our channel, you know, you have plenty of options.

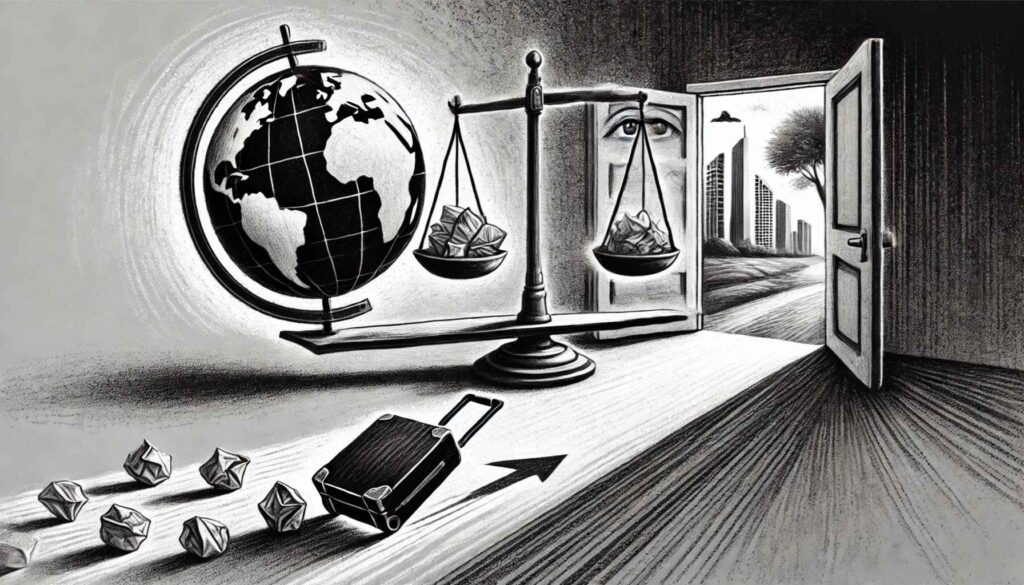

But let’s get down to business, we want to help you examine your options to plan your ‘PLAN B’ with eyes wide open to avoid surprises that could spoil your journey. So, let’s dive in!

Indice del artículo

What is Tax Residency?

You’ve probably heard about tax residency, but it’s important to remember that it’s not simply a temporary procedure or just any permit. Nor is it the same as nationality or belonging as a resident to a state.

Tax residency relates to how much you owe in taxes to the tax authorities, and this can vary depending on the country and each individual’s personal situation.

Choosing where to establish your tax residency is perhaps one of the most important decisions of your life because it directly affects your wallet and your freedom. Depending on where you anchor yourself fiscally, you may have to fork out more or less money and deal with more or fewer paperwork. Additionally, it may open or close doors to certain social benefits, such as healthcare or education.

Tax residency basically refers to the country where you reside and pay your taxes. In contrast, your fiscal domicile is where the tax authorities can find you (to send notifications or communications). However, the fiscal domicile usually coincides with the tax residency.

Advantages and Disadvantages of Choosing Your Tax Residency

Depending on where you locate or register your tax residency, it will determine how much you spend annually paying taxes to the tax authorities and complying with more or fewer requirements and procedures throughout the fiscal year.

You might think that establishing a new tax residency is unnecessary, or even dangerous due to the legal conditions it entails, and you might settle for working for the state and surrendering over 50% of your income, considering it acceptable.

Or perhaps you believe that having a high income will not affect you. Or even that the redistribution of wealth resulting from tax collection is fair and justifies paying large amounts of taxes because of the services you receive.

However, you’ll be surprised to know that, in countries like Spain, politicians depend on people like you to maintain their high standards of living, making you vulnerable and causing you to lose money every day, affecting yourself and your loved ones.

Change Tax Residency: Digital Nomad

Today, many people work remotely. However, due to poor choices in their tax residency, they end up paying much more taxes than they should if they chose a different destination.

Let me tell you the story of one of our advised clients, whom we’ll call María. María, a business savvy individual in the digital field, left Spain for Panama in search of paying fewer taxes.

However, she was surprised to discover that in Panama, they also consider other factors, such as owning property in the country or being employed here, when determining tax residency.

Just when she thought she had it all figured out, she realized she needed to establish stronger ties with Panama to achieve her goal.

Common Mistakes When Changing Tax Residency

One of the main mistakes when deciding to change tax residency is wanting things to happen quickly. It’s important to understand that this process of changing tax residency, depending on the jurisdiction, can be a lengthy process that may take several months if we want the approval to be favorable, of course.

However, countries like Cyprus, Malta, Estonia, Portugal, among many others, often have a fairly quick and favorable jurisdiction change process, so depending on your needs and family situation, you need to find the country that truly suits you.

Jurisdictions like the United States, Georgia, England, Germany, Switzerland, among many others, tend to have certain additional requirements that you must meet before making your move, which can lead to the process taking longer than expected. Therefore, we recommend that before starting the tax residency change process, you seek advice from us.

In the story we told you earlier, what was María’s mistake? Unfortunately, María went through the tax residency change process alone, so she didn’t document anything before starting the process and didn’t receive any kind of advice.

She tried to establish her tax residency in Panama; however, she didn’t anticipate that, to change tax residency, she needed to establish strong ties with the destination jurisdiction in advance.

By ties, we mean housing or financial assets. Therefore, María came to us already in Panama, in a legal situation quite complicated as she had entered the country as a tourist and her days were running out to resolve her legal situation.

With our help, María managed to properly relocate and finally establish her tax residency.

Once María knew how to obtain tax residency in her new home country, she also concluded that she had to file for fiscal divorce from Spain. With this story, I want to open your eyes: in Spain, it’s not enough to just say “I’m leaving” and expect the tax authorities to forget about you.

You need to sever ties with this country as much as possible because in the future you may have to prove that you are playing by the rules in your new country, and having properties or economic or personal ties in your new destination can be an asset.

Factors to Consider When Changing Your Tax Residency

One of the factors you must consider when changing tax residency is that, in many cases, having a habitual or primary residence is a crucial factor for successfully completing the process.

Therefore, if you already have a home in your home country, the advice I can give you is to rent it out or implement another mechanism to demonstrate that your lifestyle is in this country.

Another important aspect in some countries is the need to demonstrate expenses. Therefore, keep all the receipts you can, especially those related to basic daily needs, such as gym membership payments or any other lifestyle-related services.

An essential document is the tax residency certificate. If you’ve never heard of this document, it’s important to obtain it in the country where you wish to establish your tax residency. This will facilitate the process, especially in regions with high taxes like Spain, where there is a census of individuals who contribute fiscally.

Double Taxation: How Does it Affect Your Change of Tax Residency?

If it’s your first time changing tax residency, it’s extremely important that you seek proper advice. Because when making this change, it’s advisable to opt for a jurisdiction that has signed the double taxation treaty.

What is double taxation? It refers to the situation in which an individual is considered a tax resident in two different countries.

Therefore, if an individual has their habitual residence in Spain and also resides in another country for more than 183 days during the fiscal year, they will have to pay taxes on their worldwide income in Spain, according to the regulations.

However, if both countries have a double taxation agreement, they can apply tie-breaker rules to avoid or reduce double taxation.

Taking all this into consideration, if you are going to change tax residency, it’s very important to have advice that ensures a successful transition. At Nomad Tax, we are available 24/7, 365 days a year to assist you with any questions or concerns. Contact us.