There is a mantra repeated in forums, Asunción cafés, and Telegram groups that turned paraguay cryptocurrency into the favorite promise of traders and investors: the supposed guarantee of “0% taxes” on it. But the questions inevitably follow: how close to reality is that promise? Are we facing a genuine opportunity or just another fiscal mirage?

History has shown us one thing: when States feel their revenue is threatened, they always find a way to reach into your pocket. If it is not through a direct tax, they do it with vague regulations, forced interpretations, or exceptional measures. What begins as a scenario of freedom often ends up as a minefield of obligations.

Paraguay is no exception. The appeal is real, yes, but under very specific conditions. There is no direct tax on paraguay cryptocurrency, but believing this equals a free pass is the mistake that can cost you not only money but also your financial freedom.

In this blog, we will explain the risks of operating with paraguay cryptocurrency without a clear plan and, more importantly, the tax strategies you need to apply to seize the opportunities without becoming a target for the tax authorities.

Indice del artículo

Are there taxes on paraguay cryptocurrency?

When it comes to paraguay cryptocurrency, what really matters is not the flashy “0% tax” headline, but the legal conditions that can sustain or collapse that promise.

The hidden trap behind the principle of territoriality

The foundation of Paraguay’s tax system is simple: you only pay taxes on what you generate inside the country. This means that if your operations take place on foreign exchanges and do not interact with Paraguayan banks or clients, there is no clear legal basis for the tax authority to demand taxes. That is the root of the 0% narrative.

But be careful, Nomad: confusing territoriality with impunity is a serious mistake. The absence of a specific tax on crypto does not mean that paraguay cryptocurrency is fully safe from tax scrutiny.

When the mirage turns into a tax obligation

The risk appears as soon as a transaction leaves a trace in Paraguay. A transfer to a local bank, a sale to a resident, or the use of a national broker may be enough for the tax administration to interpret that your income was generated in the country.

And once the tax authority frames the transaction, the consequence is clear: it may demand 8% on capital gains or even up to 10% under the Corporate Income Tax if it interprets that your activity has a commercial nature.

At that point, the supposed “crypto paradise” stops being a promise and becomes a real tax obligation, capable of triggering sanctions and wealth audits.

Risks of operating with paraguay cryptocurrency

Talking about paraguay cryptocurrency means talking about a field full of opportunities, but also risks that many prefer to ignore. Operating without a strategy can turn the initial advantage into an unexpected obligation before the tax office.

Law 6380 and its reach over cryptocurrency

Although there is no direct tax on crypto, Law 6380 gives the tax authority the power to assume that any unexplained wealth increase comes from taxable income. In practice, this means that if you cannot demonstrate the origin of your funds, the tax office may apply taxes even though the law does not explicitly mention paraguay cryptocurrency.

In short, the risks do not come from a specific tax, but from how what seems like a simple administrative detail can become the basis for a full investigation.

Can you pay with paraguay cryptocurrency without tax issues?

Many believe that using crypto as a payment method is a way to avoid the tax office. But in practice, paying with paraguay cryptocurrency can be the fastest shortcut to a tax obligation.

The payment that becomes a barter

For the tax authority, handing over Bitcoin in exchange for a good or service is not a simple payment: it is a barter. That means you first “sell” your cryptocurrency, generating a gain that must be justified, and then you buy the product or service. What seemed like an everyday transaction turns into a taxable event.

Thus, although many think they can pay with paraguay cryptocurrency without leaving a trace, every transaction is an opportunity for the tax office to act. What looks like a simple daily gesture ends up being the perfect excuse to audit your income. But there is an even more exposed scenario: when you use crypto to acquire high-value assets.

Buying assets with paraguay cryptocurrency – the risk in real estate transactions

Among all possible operations, purchases of real estate, vehicles, or service contracts in Paraguay are the ones that most quickly trigger tax alerts. Imagine buying an apartment in Asunción with Bitcoin. For the tax authority, that transaction is not a direct payment: first it is interpreted as a sale of cryptocurrency and, second, as a real estate purchase.

The result: presumed gain, obligation to justify the origin of funds, and if you fail to justify the wealth increase, the transaction falls into the category of unjustified wealth increase, with penalties and loss of financial peace of mind.

In other words, operating with paraguay cryptocurrency can turn high-value purchases into the fastest way to enter the tax radar.

Tax strategies for paraguay cryptocurrency

After reviewing the risks, it is clear that operating without planning is a dangerous game. The good news is that there are tax strategies for paraguay cryptocurrency that allow you to benefit from the flexibility of the system without being exposed to the tax office.

Documenting is shielding your wealth

This is not bureaucracy—it is your strongest shield. Keeping records of wallets, movements, and exchange operations is the first line of defense against any audit. If the tax authority knocks on your door, having your paperwork in order makes the difference between a quick clarification and a major problem.

Keep funds away from local banks

Every time you move money through a Paraguayan bank, you activate an automatic presumption. Avoiding this trap is as simple as keeping your funds outside the local financial system. The less trace you leave, the narrower the tax authority’s margin of action.

Plan every move before operating

Before moving in or out with crypto, define how you will do it. If you are a resident, your obligations multiply; if you are not, act accordingly: no local brokers, no sales to residents, nothing that unnecessarily ties you to the country. Here, the winner is not the one who takes the biggest risks, but the one who plans best.

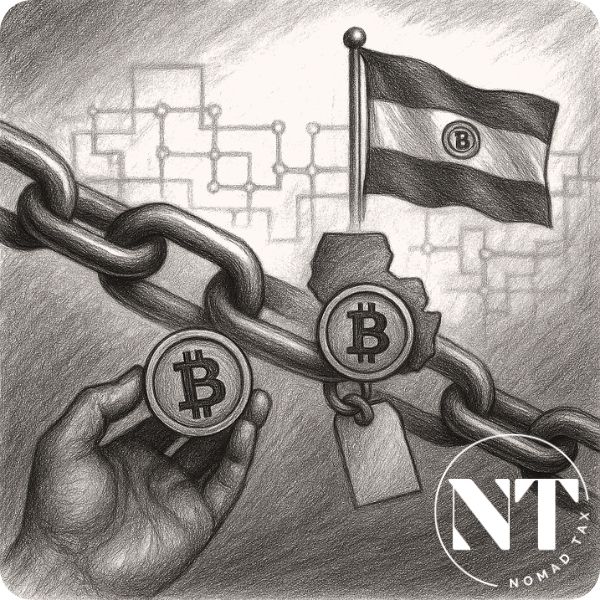

The anonymity myth in cryptocurrency is not just in Paraguay

Even though Paraguay operates under a territoriality principle, cryptocurrency does not exist in a bubble. Every transaction is recorded on the blockchain and connected with international reporting standards.

Today, authorities have access to:

- Forensic software (e.g., Chainalysis): wallet and flow tracking.

- Public blockchain: permanent and auditable data.

- International cooperation: exchange between agencies.

And on top of this, new rules reinforce traceability:

- Travel Rule (FATF): mandatory identification in crypto transfers.

- DAC8 (EU, 2025): automatic reporting of crypto asset users.

- CARF (OECD): global standard for information exchange.

In this context, the risks of operating with paraguay cryptocurrency are not limited to the local framework. If your operations go through regulated banks or exchanges, the data always ends up in the hands of the tax authority and is cross-checked internationally. Therefore, the anonymity myth is dead: the only real protection in 2025 and beyond is a well-structured tax strategy.

Conclusion: Paraguay cryptocurrency, opportunities and limits

The “0% tax” headline turned Paraguay into a magnet for traders and digital nomads. But as we have seen, paraguay cryptocurrency is not free from risks: Law 6380, unjustified wealth increases, and everyday transactions are the cracks through which the tax authority can step in.

The opportunity exists, but it is not automatic. Without strategy, what seems like an advantage becomes an obligation. With planning, however, Paraguay can be fertile ground for those who know how to play their cards.

In the end, financial freedom depends on designing a plan that allows you to operate safely. At Nomad Tax we always repeat it: the winner is not the one who improvises, but the one who anticipates.