Setting up an offshore company in 2025 is not just a tax strategy, it’s a declaration of independence.

But between so many empty promises, recycled tutorials, and rushed consultations, making the right decision has become harder than ever.

Today, we’re going to walk you through 3 examples of offshore companies based in Hong Kong, the United States (LLC), and the United Kingdom (LLP)—structures that keep appearing in every ranking because, in theory, they help you pay less tax, and give you more control and global access.

Nomad, the goal is not to convince you to choose one jurisdiction over another. What’s at stake here isn’t just what percentage you give away to the tax office. It’s your operational capacity. Your reputation. Your access to banking. Your freedom to invoice without having your account frozen for “suspicious activity.” Because if you set up a company “just in case”, without understanding how to report or use it, you could be exposed to automatic information exchange under CRS—without even knowing it.

So, in this blog, we’ll focus on answering these key questions:

• What are the advantages of an offshore company in Hong Kong, the UK, or the US?

• What are the disadvantages of an offshore company… the ones you only discover when it’s too late

• What is the difference between an LLC and an LLP?

• And what is the best jurisdiction for an offshore company—based on your situation, not someone else’s.

We hope this blog reaches you at a time when you’re thinking ahead. Because if you open an offshore company without knowing how it works, you’re not optimizing—you’re signing a problem with a due date.

Indice del artículo

Who Are These 3 Examples of Offshore Companies in 2025 Really For?

When we decided to talk about these 3 examples of offshore companies, our goal wasn’t to promote a trend. It was to help you identify whether an LLC, LLP, or a Hong Kong company can be a powerful tool—or a dangerous misstep—depending on your profile.

“Anyone can open an offshore company. But not everyone is in a position to use it properly.”

Choosing an offshore company shouldn’t be based on “what’s trending” or what worked for someone else. It requires a clear understanding of your tax situation, your income sources, and your long-term strategy. It’s about building a solution in a system that was never designed for people who work across borders.

If your profile aligns with one of the following, then setting up an offshore company might be the right move:

- Freelancers earning in USD and living across time zones

If your income comes from abroad, your legal structure shouldn’t depend on a country that doesn’t even recognize your operations. An LLC or LLP can help you optimize your taxes and avoid double taxation. - Remote consultants working across multiple countries

If your laptop is your office and your location keeps changing, an offshore company can provide operational, banking, and legal stability. - E-commerce businesses selling across regions

If you sell in Europe, produce in Asia, and get paid in dollars, chances are your local company isn’t built for that model. A Hong Kong offshore company can help you manage cash flow, optimize taxation, and gain international legitimacy. - Agencies with global teams and distributed clients

If your structure is already global, your company should be too. LLPs in the UK or LLCs in the US give you access to multi-currency accounts, easier hiring, and better reputation with banks and clients. - Investors and traders moving capital across border

If you operate in multiple jurisdictions, doing it under your personal name is a risk. A well-structured offshore company can protect your assets and give you access to financial services you couldn’t access before.

What follows is a clear look at the light and dark sides of the 3 examples of offshore companies that get the most media attention in 2025.

What Are the Advantages of an Offshore Company: LLC, LLP, or a Hong Kong Ltd.?

Now let’s get into the details and look at the 3 examples of offshore companies most commonly used in 2025: the U.S. LLC, the U.K. LLP, and the Hong Kong Ltd. Because if you’re wondering what are the advantages of an offshore company in these jurisdictions—here’s what you need to know, no sugarcoating:

US LLC: Tax Flexibility and Operational Control

The LLC remains the most popular entry point for those seeking a structure that’s agile, recognized, and easy to maintain.

- Simple Taxation (if your country allows it): A U.S. LLC can be taxed as a pass-through entity, meaning the profits are reported directly on the owner’s personal tax return.

This avoids double taxation—especially if your country of residence recognizes pass-through taxation.

You can also choose S-Corp status, which can help reduce certain self-employment taxes. - Asset Protection: Members of an LLC are not personally liable for the company’s debts or legal issues. That makes it a powerful legal shield.

- Tax Deductions and Efficiency: LLCs can deduct most operating expenses—and even international ones if properly documented—making it possible to significantly lower your taxable base.

- Low Compliance Burden: The U.S. system is much lighter than Hong Kong’s: No annual audits. No certified financial statements. Just a few basic IRS forms. Perfect for digital nomads and freelancers working from a laptop.

- Accessible Banking (With Conditions): U.S. banks can tell the difference between a real business and a sketchy shell. You can open a business account without ever stepping foot in the U.S. As long as your LLC shows substance, you’re treated like a legitimate operator. In fact, the LLC is often more bankable than other, more exotic offshore setups.

UK LLP: Tax Transparency with International Recognition

The UK LLP has become a favorite among agencies, law firms, creative studios, and digital businesses with distributed teams.

- Transparent Taxation: Like an LLC, the LLP itself doesn’t pay corporate tax. Instead, the partners declare their profits individually in their country of residence. The big advantage? The LLP is explicitly recognized in most double tax treaties, helping you avoid surprises, double taxation, and unexpected letters from your local tax authority. Unlike the US LLC—which many countries still view as a “tax limbo”—the LLP has full diplomatic recognition in international tax agreements.

- Global Reputation: Unlike lesser-known structures, the LLP is listed by name in many treaties.

This gives you fewer headaches with your local tax office and more trust from banks and service providers. - Adaptable Structure: No board of directors. No shares. The LLP can be as formal or as flexible as your business needs.

- Low Compliance: The UK won’t drown you in paperwork. You’ll need to file an annual declaration, and audit your accounts only if you pass certain thresholds. It’s designed for professional partnerships but works perfectly for international setups with a clean structure. Ideal if you want a functional company without a never-ending to-do list.

- European Banking (The Good Kind): When it comes to banking, few structures are as welcome as the LLP. Relatively easy account opening. Smooth access to multi-currency accounts. It works well for non-residents and radiates legitimacy. London may have a reputation, but when it comes to serious operations, the LLP remains one of the most bankable offshore structures in Europe.

And if you’re still wondering what are the advantages of an offshore company in the UK, the LLP represents one of the most robust options for those seeking tax transparency and international credibility.

Hong Kong Ltd.: Tax Efficiency and Access to Asia

If your business operates in Asian markets—or you’re looking for a stable corporate environment with real tax advantages—Hong Kong remains one of the most strategic places to structure.

- Territorial Tax System: Only income generated within Hong Kong is taxed. If you can prove your revenue comes from outside, you may qualify for 0% corporate tax.

- No Withholding Tax on Dividends or Capital Gains: This allows capital to move freely within the company, without erosion from tax.

- Local Income Tax Rates: 8.25% on the first 2 million HKD, and 16.5% thereafter.

- No VAT

- Fast and Fully Remote Registration: You can set up a company in under a week, and the entire process can be done online.

- Solid Banking Infrastructure: While Hong Kong’s banks are strict with companies that lack substance, if you meet the requirements, they offer: Multi-currency accounts, Access to international investments, Strong regional banking reputation

In the end, these 3 examples of offshore companies have one thing in common: They offer clear advantages to those who know what they’re doing.

What Are the Disadvantages of an Offshore Company: LLC, LLP, or Hong Kong Ltd. in 2025?

While the 3 examples of offshore companies we’re analyzing offer powerful advantages, it’s crucial to understand the risks and complications that can arise if you structure them incorrectly.

LLC: What You Need to Know Before You Misuse It

Transparent… but only if your country says so

An LLC is only “light” if your country of tax residence recognizes it as a pass-through entity. If it treats the LLC as opaque (as is the case in the UK, Denmark, and parts of Latin America), get ready for double taxation: corporate tax plus personal tax. The worst of both worlds.

It’s not anonymous

Since 2024, under the BOI Report, the U.S. requires complete disclosure of who you are, what you do, and where your money comes from. Still think an LLC is discreet? It’s not. Now it’s a fiscal display window, with your name on it.

Banking is not a free ride

If you’re in high-risk or grey sectors, like unregulated crypto, gambling, or unclear consulting, U.S. banks will block you or ignore you completely. If your business activity isn’t clear, what seemed simple becomes a nightmare of fees, rejections, and invasive questions.

An LLC can be an excellent structure—if you understand its scope and use it correctly. But if you choose it just because it’s easy to open, you’re not ready.

LLP: What You Should Know Before Jumping In

Compliance: no room to hide

Don’t mistake a “low admin burden” for a free pass. The public register of beneficial owners is mandatory, and in the UK there’s zero tolerance for opaque structures. If your plan was to disappear from the radar… this is not the place. The LLP demands transparency—even if it doesn’t bury you in forms.

Banking? Depends on your profile

If your business operates in sectors like crypto, online gaming, or substance-free consulting, UK banks will scrutinize every detail. And if you’re from a “high-risk” country, forget the red carpet. The ease disappears fast when your profile doesn’t fit.

The UK LLP is a strong option, if you use it strategically. It’s clean, transparent, bankable, and globally respected.

But if you’re looking to hide, fake it, or patch things up… look elsewhere.

HK Ltd.: What You Need to Know So That 0% Doesn’t Turn Into 16.5%

The 0% Is Not Automatic

Forget the fantasy of “sign the papers and done.” Every year, you must prove and document that your revenue is 100% foreign-sourced. That means real contracts, operational substance, and fiscal coherence.

If you can’t justify it, Hong Kong will treat you as a local tax resident and apply 16.5%, no appeal.

Expert-Level Compliance

Hong Kong isn’t the kind of jurisdiction where you open a company and forget about it.

- Annual audited financial statements. No exceptions.

- Audit must be done by a locally registered professional—no improvised accountants from elsewhere.

- Company secretary is mandatory.

- And you need at least one director. They can be a foreigner, but if they reside in Hong Kong… watch out.

That “harmless detail” can mean that the place of effective management is in Hong Kong, and that means you lose the tax benefit automatically.

Banking Access: Yes… But Not for Everyone

Incorporating is easy. The hard part comes after—when you have to convince the banks that your structure is legitimate.

If you don’t have a local director or real substance in Hong Kong, most banks will ignore you.

If your business is digital, service-based, or consulting—or if your country has a poor tax reputation—they’ll flag you. Prepare for intense questions, delays, and scrutiny.

Crypto Regulations and Their Impact on the 3 Examples of Offshore Companies

If you operate with crypto assets, 2025 is nothing like two years ago.

- Hong Kong now requires specific licenses and operational limits for exchanges and wallets.

- The UK mandates the reporting of transactions on decentralized platforms and links wallets to individuals.

- The U.S., through the IRS and FinCEN, is tracking blockchain activity more aggressively than ever.

Does this mean you can’t use an offshore company if you work in crypto? No, but it does mean you’ll need a different strategy.

Jurisdictions like El Salvador, Dubai, and Panama are positioning themselves as crypto-friendly alternatives, offering better regulatory clarity and practical frameworks for global operators.

Let us help you build a solid tax strategy.

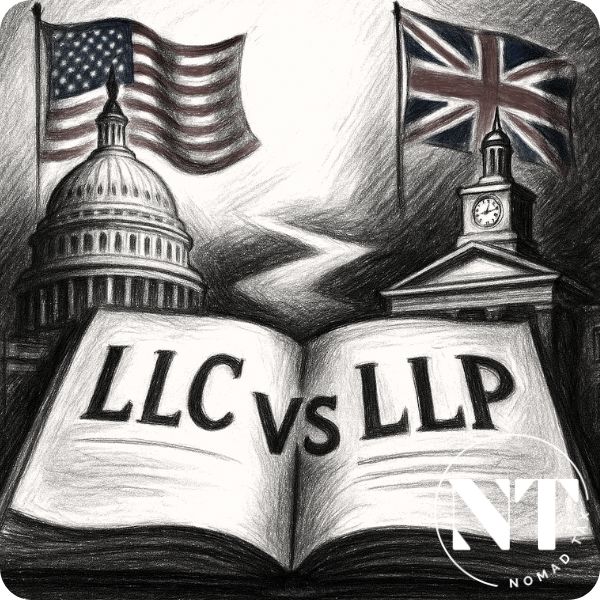

What Is the Difference Between an LLC and an LLP Within the 3 Examples of Offshore Companies? Taxation and Reporting

When analyzing the 3 examples of offshore companies most commonly used, two structures often raise questions: the U.S. LLC and the U.K. LLP. At first glance, both offer pass-through taxation—meaning the company doesn’t pay taxes at the entity level; instead, income “passes through” to the members or partners, who report it on their personal tax returns.

But that “simplicity” hides important differences:

- The LLC is governed by U.S. law, and its tax treatment depends on how your country interprets it.

Some countries treat it as a transparent entity, others as opaque. That can lead to unintended double taxation—and you might not realize it until it’s too late. - The LLP, on the other hand, is explicitly recognized in many double taxation treaties.

Its legal framework is more predictable and widely accepted internationally.

What About Reporting?

- An LLC, when operating as a pass-through structure, has minimal administrative requirements.

But since 2024, with the implementation of the BOI Report, it’s no longer confidential.

The U.S. now requires disclosure of the beneficial owners’ identity. - An LLP, if operating under certain revenue thresholds, is also exempt from audits and complex filings.

And its transparent status is recognized in more jurisdictions than the LLC.

Now that you’ve seen these 3 examples of offshore companies, what are the advantages of an offshore company, what are the disadvantages of an offshore company, and what is the difference between an LLC and an LLP. It’s time for the conclusion: what is the best jurisdiction for an offshore company in 2025?

Conclusion: What Is the Best Jurisdiction for an Offshore Company in 2025?

After reviewing 3 examples of offshore companies, the LLC in the U.S., the LLP in the UK, and the Hong Kong company, it’s normal to wonder: Which one is ideal?

The truth is, there’s no such thing as a universally “best” jurisdiction. What matters is designing a customized tax architecture that aligns your tax residency, company, and banking. If those three pillars aren’t coordinated, the system will notice.

If you open bank accounts using documents that don’t match your declared residence or company, you can be shut out of the financial system without warning. If you’ve officially exited your country for tax purposes, but still operate as if you never left, your former tax authority might still consider you a resident. If your offshore company is well-structured but you use cards or accounts that contradict your fiscal narrative, banks may block you, or worse, report you.

How to Start Your Strategy Without Shortcuts or Surprises

- Define your tax residency and make it credible.

- Choose an offshore company your country can recognize and accept.

- Open bank accounts that support your fiscal story not contradict it.

- Work with professionals in international taxation. (Right here.)

If you’ve made it this far, it’s because you’re not just looking to open a company. You want to understand how to use these tools with strategy and intelligence. And in today’s global game, that’s the only thing that truly protects you.