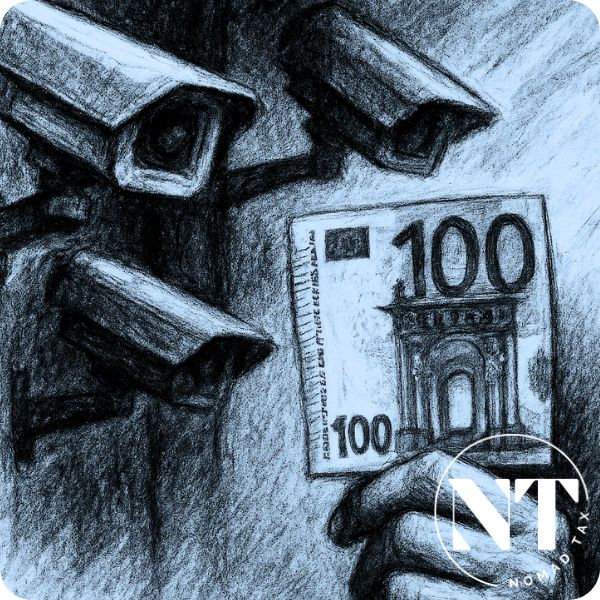

The digital euro and the future of cash in 2025 are the Trojan horse of the 21st century.

And no, this is not an exaggeration. It’s the silent plan to sell you “convenience” while you give up your financial freedom with a single click.

Today, Europe no longer imagines the future, it programs it. With a system where the State doesn’t just know who you are, where you are, or what you buy. It also decides whether you’re allowed to do it. This isn’t science fiction. Sooner than you think, your identity, your money, and your decisions will be controlled from an “App”.

Yes, Nomad, just like you read it. The most aggressive financial surveillance system in history is already under construction. And if you buy the “wrong” thing, travel too often, or say what you shouldn’t… they can freeze your account, block your funds, and silence you.

All of this, of course… for your own safety. Because according to Brussels, freedom without supervision is dangerous. And according to Lagarde, cash is a risk. So Europe keeps multiplying taxes and subtracting rights.

While Trump is working to eliminate taxes for expats and Argentina is dismantling currency controls like the ban on buying foreign currency, France is proposing to tax you even if you live abroad.

Today, many talk about digital inclusion, efficiency, and modernization. But in Europe, all that technology is being used to expand the most aggressive financial surveillance system ever implemented: the digital euro paired with the European Digital Identity (EUDI). Together, they’re the perfect duo to control every euro, every step — and even every thought.

Want to know the worst part? It’s already happening. And if you don’t act now, you’ll only realize it when there’s no exit button left. You still have yours. Click here to use it.

Indice del artículo

The New Digital Order: The Digital Euro and the Future of Cash in 2025

Europe says it wants to modernize, but what it’s really doing is eliminating your right to pay in cash and with freedom.

They call it innovation, but it’s a control strategy hidden in lines of code. The digital euro and the future of cash are not about adapting to the digital era. They’re about programming the economy. And the worst part: with no way out.

Digital Euro: What it is, how it will work, and when it will officially launch

What is the digital euro? It’s the European Central Bank’s (ECB) digital currency. An electronic money that does not rely on private banks or physical cash. It seems useful, it seems secure. But it is not neutral.

It’s not like using your debit card. It’s a system designed to know how much money you have, how you use it, and who you send it to. A kind of mandatory state-controlled e-wallet that doesn’t need permission to access your life.

Its structure is simple, and dangerous:

- It will be issued directly by the ECB.

- It won’t be managed by private banks.

- And it will be tied to your European Digital Identity (EUDI).

The result? Money with no privacy, full of conditions, and trackable in real time.

And no, this isn’t a conspiracy theory. It’s a project that has been in development since 2021, with the ECB moving through three phases:

- Launch phase (from 2025): Gradual rollout to the public.

- Research phase (2021–2023): Feasibility and design.

- Preparation phase (2023–2025): Prototypes, pilot testing, and development — the current stage.

When will it officially launch? A decision is expected in October 2025, but that does not mean immediate rollout. It means the ECB will evaluate whether to proceed with full implementation.

The European Central Bank and the digital euro: Lagarde’s role and the CBDC agenda

Behind the polished talk of innovation, the European Central Bank has been quietly laying the groundwork. And ECB President Christine Lagarde has been clear:

“We want a digital euro that is not completely anonymous.”

Because according to the ECB, cash is unsafe, outdated, and “too dark.” But the real reason is something else: total fiscal control, with no cash as a shelter.

Like all central bank digital currencies, the digital euro includes deeply concerning features:

- Programmable money (yes, with rules for when, how, and what you’re allowed to spend it on).

- Spending limits, based on your behavior or location.

- Expiration dates, to force you to use the money or lose it.

In March 2025, in a leaked interview, Lagarde even admitted that the digital euro could be used to “limit certain consumption behaviors” in the name of environmental or financial safety.

Lessons from the digital yuan: What Europe doesn’t want you to know

If you want to understand the digital euro and the future of cash in 2025, you need to look at China. Not to admire it, to take it as a warning.

The digital yuan, also known as e-CNY, is already live. It is the most advanced (and most dangerous) example of how a government can use a central bank digital currency (CBDC) to gain absolute control.

Unlike cash, the digital yuan is not truly yours. It is issued, programmed, and monitored by the State. Every transaction is recorded, every purchase is tracked, and your financial behavior becomes part of your social record.

This is the day-to-day reality in a system where:

- Access to your money can be blocked if your social score drops.

- You can be restricted from spending your money in certain locations or on certain items.

- Your funds can be given expiration dates to force specific behaviors.

The control is total. And the worst part? They sell it as efficiency.

And Europe? It already has the technology. The excuse? Cash cannot be controlled. But the digital euro can.

Christine Lagarde, heading the ECB, has already said the digital euro will be “programmable in specific cases”, and that it allows for “responsible control” by the authorities. What does that really mean?

It means the same level of financial surveillance we see in China could soon be reality in Europe, powered by the digital euro.

The European Digital Identity (EUDI): The Other Arm of Control

If the digital euro is the lock, the European Digital Identity (EUDI) is the key.

What is the European Digital Identity (EUDI)?

It’s a unified system that allows you to store and validate your identity, medical history, driver’s license, academic degrees, and professional credentials—all in one place. All in one “App”. And all in the hands of the State.

Sounds convenient? Sure.

A digital wallet that, under the promise of “making your life easier,” centralizes every piece of personal data that was once scattered.

The problem isn’t using it. The problem is what they can do with your information without your knowledge. And this is already being flagged by independent data protection bodies.

A 2025 report reveals that the EUDI system relies on weak cryptographic algorithms, opening the door to data leaks and unauthorized access. The result? Your privacy depends on no government employee making a mistake. On no hacker getting in. On no new law quietly expanding its reach.

The EDPS (European Data Protection Supervisor) and the EDPB (European Data Protection Board) issued a joint opinion on the regulation of the digital euro. In it, they expressed serious concerns about the centralization of personal data and the possibility that the European Central Bank (ECB) or national central banks could gain excessive access to sensitive user information.

How EUDI and the digital euro connect to surveil you

On their own, they already raise concern. Together, they’re the full package to control you: identity and money, linked within the same network.

- Your digital identity defines who you are.

- The digital euro decides what you can do with your money.

Want to rent a home? EUDI validation. Want to open a bank account? EUDI validation. Planning to travel, shop, study, or simply work? Everything goes through it. And if you don’t fit the “acceptable profile”… the system reacts:

- Your score is lowered.

- Your paperwork is delayed.

- Or worse, you’re blocked entirely.

Does it sound like an exaggeration? It’s the European bureaucrat’s dream: an obedient, predictable, traceable citizen. All under the same logic of preventive control.

Because if they can register you, they can monitor you. And if they can monitor you, they can condition you.

That’s how the digital euro and the future of cash in Europe end up being defined by one core truth:

Whoever doesn’t hold control… gets controlled.

Learn more before choice disappears.

European Climate Before Financial Digitalization

While some keep repeating that the digital euro and the future of cash bring inclusion and efficiency, reality is heading down a very different path. In Europe, there is now more control, more regulations without public debate, and an increasingly invasive tax system. This is not about “fear-mongering theories,” but about real laws, official proposals, and political decisions that are being made right now.

European Union: Military spending above 3% of GDP?

The President of the European Commission, Ursula von der Leyen, has proposed freezing the EU’s fiscal rules to prioritize defense spending. This would mean temporarily suspending the limits on deficit and public debt so that member states can exceed 3% of GDP in military expenditure — without having to justify fiscal imbalances to Brussels.

And what’s the excuse? “To secure peace,” they say.

But in practice, it means that while you’re asked to tighten your belt on public services — like education, healthcare, and pensions — the gates are opened to finance more weapons, more control, more surveillance.

With higher taxes, less cash, and a programmable digital currency you can’t escape.

Because the digital euro and the European digital identity (EUDI) are not about efficiency.

They’re the tools they need to fund their agenda — without asking your permission.

France wants to tax you for being French, and asks workers to “save the economy”

Yes, you read that right. In 2024, a proposal was made to implement a tax on citizens living abroad, simply for holding a French passport. A model of citizenship-based taxation, like the United States — but without the opportunities or freedoms that come with it. Don’t live in France? Don’t earn there? Don’t spend there?

They want your money anyway. And Spain… is already eyeing the model.

At the same time, the French Senate proposed that workers donate one unpaid working day per year to help reduce the national deficit. Senator Philippe Mouiller, President of the Social Affairs Committee, explained that this would be a direct contribution from active workers. In plain terms: one full day of mandatory, unpaid labor every year.

Germany: Military service returns? And the EU Emergency Kit?

While you struggle to make ends meet, Germany is already discussing reinstating compulsory military service in 2025. Why? Because, according to them, young people need to be ready for war.

And that’s not all. The European Union recommends you prepare an Emergency Kit with water, medicine, and supplies for 72 hours. They call it “prevention.” It sounds more like preparing for collapse.

Ireland: They can take your home without a trial

Welcome to the future of private property. Ireland now allows preventive confiscation of assets, Even without a prior conviction. The reason? “Suspicion.”

You don’t have to be guilty. There’s no sentence. No trial. Just confiscation.

Estonia: Freedom of expression on the edge

Estonia, one of the EU’s “digital models,” is passing laws that could send journalists to jail for publishing information or criticism that bothers those in power.

The new crime? “Defamation” or “improper use of data.” Translation: If you make the government uncomfortable, they shut you up.

You still have time to act.

How to avoid the digital euro and keep control over your money

The good news? You’re still on time. The bad? Not for long.

The digital euro and the future of cash in Europe are no longer speculation. They are real and designed to eliminate all exits from the system. But they haven’t succeeded completely yet. There are still ways to protect your financial freedom without falling into illegality or shady schemes.

Legal strategies to escape the digital euro

You don’t need to hack the system. You just need to understand it better and take action.

These are the paths that still work today (but might disappear soon):

- Tax residency in countries without CBDCs or EUDI: if you don’t live under their flag, they can’t force you to use their digital currency or surveillance apps.

- Bank accounts in non-European jurisdictions with less intrusive regulations.

- International asset planning: legal structures that spread your wealth across countries to avoid fiscal concentration or automatic confiscation.

- Investments in non-digitizable assets: real estate in off-radar countries, physical gold, private equity, etc.

- Foreign-source income: if you live in a country with territorial taxation, your global income is out of reach.

None of this is illegal. But it is urgent. Because the more they implement tools like the digital euro, the more doors will close.

Real alternatives: international structures and fiscal residencies without CBDC or EUDI

Where can you still breathe freely? These countries exist. But you won’t find them on the front page of any ranking.

- Paraguay, Panama, and Guatemala: territorial taxation, no EUDI, no CRS.

- Namibia: an African gem with 0% tax on foreign income and banking privacy.

- North Macedonia and Armenia: low tax burden, no strict stay requirements, and still off Europe’s radar.

- El Salvador: no tax on foreign income, crypto-friendly, and not under EU financial supervision.

Conclusion: They won’t ask for permission to take away your freedoms

The digital euro and the future of cash are not a technical debate. They are a battle for control over your life.

And while many keep sleeping, praising convenience and modernity, the machine is already running.

The State doesn’t need to enter your home to watch you — it only needs to enter your phone.

It doesn’t need to fine you to censor you — it only needs to freeze your account.

It doesn’t need to send an inspector — just a single click is enough.

Europe has made its direction very clear:

- Mandatory digital identity

- Programmable money

- No escape from taxation

A system designed to make you obedient, predictable, and traceable.

There are still alternatives. Don’t wait any longer.

👉 Book your personalized consultation

And let’s design your strategy before all the rules change.