There’s a truth no one wants to tell you:

You don’t need to be a millionaire to stop financing a system that punishes you for trying to get ahead. There are low-tax countries for expats that let you build a dignified life—without the State breathing down your neck every quarter.

Want a number that says it all?

By 2024, more than 130 countries were already exchanging financial data automatically under the Common Reporting Standard (CRS).

If you choose the wrong country for your new residence, your tax strategy can become your worst enemy—without you even noticing.

Javier learned that the hard way. He was a freelance UX designer living between Spain and Portugal, and he ended up taking out a loan just to pay taxes he didn’t even fully understand.

Now? He lives in a low-tax country, holds a residence without physical stay requirements, and most importantly, he no longer checks the calendar every time he gets paid.

Today, we’re breaking down why more freelancers like Javier, and a growing number of entrepreneurs, are choosing territorial tax countries with no CRS agreements, where the State doesn’t chase you for every cent, but instead lets you grow freely, with no tricks and clear rules.

Armenia, Macedonia, Guatemala, and Namibia, four countries with favorable tax systems, low or 0% tax, and outside the CRS radar in 2025.

And yes, no one there asks why you’re working from a laptop.

Indice del artículo

Why Look for Low-Tax Countries for Expats Outside the Usual Destinations?

The End of the “Classic” Tax Havens

Javier wasn’t a tax dodger or a financial guru. He was a self-employed professional, responsible, hard-working… and completely suffocated by taxes.

He lived between Lisbon and Madrid, paid his taxes religiously, and still couldn’t make ends meet. Like many, he thought moving to Portugal, once considered one of the best low-tax destinations for digital nomads, would solve everything. But when the benefits started disappearing and the system treated him like an ATM, he realized something: the problem wasn’t him. It was the map.

Portugal, Thailand, Andorra… When Popularity Becomes a Trap

For years, Javier thought these were the best low-tax destinations for digital nomads.

But when thousands of freelancers and investors land in the same place at the same time, something breaks.

The benefits shrink, political pressure builds, and governments react:

taxes go up, laws change, and entry requirements tighten.

Thailand launched its LTR visa with elitist requirements (More info here), Portugal scrapped its NHR regime, and Andorra… well, it’s becoming less private, more expensive, and increasingly watched.

What used to be a safe haven is now a gold-plated trap.

What Happens When Everyone Moves to the Same Place?

That’s when it hit Javier: when everyone runs toward the same safe haven, it’s only a matter of time before it stops being safe.

Global scrutiny kicks in, and with it come tax reforms that used to favor expats. Prices surge, bureaucracy collapses, and what once felt like freedom starts to feel like a net tightening.

That’s when Javier knew it was time to move on, to look for a new tax residency.

How CRS, Inflation, and Fiscal Saturation Leave You Cornered

Inflation doesn’t wait, and governments with fiscal deficits will always find ways to squeeze more out of you. That’s why it’s not just about paying less. It’s about finding low-tax countries for expats, outside the CRS, where you can live legally, safely, and without traps.

Exactly like Javier did.

Tax Gems: Countries with Favorable Tax Systems for Expats in 2025

Armenia: The 0% Micro-Business Nobody Talks About

How the micro-business regime works for freelancers and entrepreneurs

For Javier, Armenia was a total surprise. He discovered a system that almost no one talks about, but it could be a smart move for many digital nomads and small-scale entrepreneurs. Armenia allows you to legally pay 0% tax if your annual income is under $60,000 USD and you enroll in the micro-business regime. But this isn’t just a tax break it’s a statement. Armenia wants talent, and it shows it with clear rules, low costs, and no fine print.

Residency in Armenia for freelancers: simple, legal, no drama

Armenia doesn’t have a flashy digital nomad visa, but it offers something better: a real, legal, and straightforward way to live and work remotely there. Any foreigner can register as a Private Entrepreneur without being a resident, through the Ministry of Justice. And the best part? You can do it online with an e-signature or in person, and it only costs 3,000 AMD.

Once you’re registered and operating, you can apply for a Temporary Residence Card, valid for one year and fully renewable. This path remains open in 2025 and is one of the fastest and cleanest routes to legal tax residency for freelancers who want a stable tax base in a growing tech environment.

Dividends, capital gains, and crypto: what do you really pay?

Armenia’s 20% flat tax is already competitive, but dividends are only taxed at 5%, and long-term capital gains can be exempt. Plus, since February 2024, Armenia approved its Crypto Asset Law, creating a legal framework that offers clarity for crypto investors. The space is still young and may evolve, but right now, Armenia strikes a rare balance: low tax, legal stability, and migration ease.

What no one says (but matters)

Armenia isn’t perfect. The economy is small, the currency isn’t strong, and geopolitics in the region can get tense. But if you’re looking to build something of your own, it offers something rare: freedom with clear rules and low barriers to entry. And if you stick around, after just three years of residency, you can even apply for citizenship. For expats who value strategy, mobility, and smart tax planning, Armenia is still one of the world’s best-kept secrets.

North Macedonia: A Flat 10%—No Complexity, No Pressure

Flat tax, free zones, and no CRS

What if you could live in Europe and only pay 10% tax, with no brackets, no scaling, no endless paperwork? That’s what North Macedonia offers. It’s not a trending destination, but it’s attracting smart nomads and entrepreneurs who want low taxes without the burnout.

The flat tax applies to personal income, business profits, rent, and royalties. And North Macedonia does not participate in the CRS, which gives you a level of financial privacy that’s getting harder to find.

How to get residency through real estate

Buying property in Skopje for around €50,000 gets you access to legal residency. But there’s more, if you set up a tech business inside a Free Economic Zone, you could enjoy 0% corporate tax for the first 10 years. For someone who wants to invest without getting stuck in EU bureaucracy, North Macedonia is the perfect blend of simplicity, stability, and flexibility.

It’s one of those countries with favorable tax systems for expats that’s still flying under the radar.

What to keep in mind

It’s not all sunshine. Macedonia taxes worldwide income, even if it’s just 10%, you’ll still have to report it. There’s no dedicated visa for retirees or passive income earners, so you may need to set up a business structure to justify your stay. And yes, the language barrier, local bureaucracy, and judicial system might slow things down.

Still, for entrepreneurs with vision, it remains one of the best low-tax destinations for digital nomads in 2025.

Namibia: Javier’s Unexpected African Tax Haven

Territorial taxation, real and simple: how it works and why it matters

To Javier, Namibia seemed like just another exotic destination until he discovered it was a fiscal goldmine.

Namibia uses a source-based taxation system: if you earn your income outside the country, you don’t pay taxes on it. Period. Living off dividends, crypto, or foreign rental income? Namibia doesn’t get involved. And if you’re running an international business, it gets even better some export manufacturers can deduct up to an additional 80% of net income, giving global structures a serious edge.

There’s no capital gains tax, even when selling real estate or business shares within Namibia something rare and incredibly valuable for investors. Plus, there are no wealth, inheritance, or gift taxes, making Namibia ideal for long-term wealth and estate planning.

How to obtain residency (and why it works for retirees)

Namibia offers temporary residency permits for investors, retirees, and professionals, with the option to apply for permanent residency after meeting specific criteria. Requirements include proof of income, a clean criminal record, and a medical exam. As of 2025, official government fees are N$2,600 for annual temporary residency and N$20,000 for permanent residency. Student and temporary work visas are also available, and unlike many countries you can apply online, making the process more accessible for expats.

You can also secure residency by investing in real estate (from $300,000 USD) or by showing passive income of at least $2,000 USD/month. With English as the official language, stable politics, and a calm, spacious lifestyle, Namibia stands out as a hidden fiscal gem on the African continent.

For retirees and remote earners like Javier, Namibia offers a legal tax residence without excessive stay requirements, at a reasonable cost and with real quality of life.

What to consider

If you earn money locally, Namibia will tax it, and rates can go as high as 37%. Immigration procedures are a bit more demanding than in other low-tax countries, and the economy is still heavily reliant on mining (especially diamonds and uranium), which makes it vulnerable to global shocks.

That said, if you don’t depend on local income, Namibia remains one of the most solid low-tax countries for long-term planning. While it has cooperated with international forums, Namibia has not adopted CRS nor signed automatic banking info exchange agreements, a key factor for those who prioritize legal privacy and structural control.

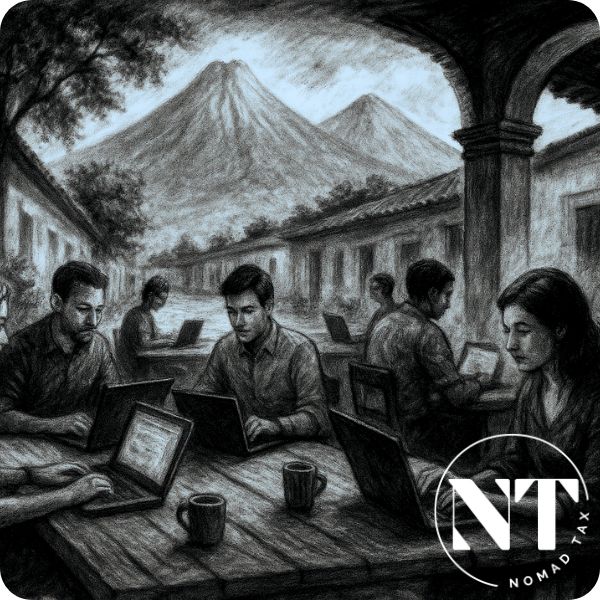

Guatemala: No CRS and No Tax on Foreign Income

Tax residency with no stay requirements

Guatemala is one of those rare places where you can legally live with 0% tax outside of Europe, without being tied down to a single location. It doesn’t require full-time presence, which makes it perfect for nomads who want to keep their geographic freedom. Foreign income? Not taxed. Banking? Private. CRS? Not a member, which means your financial info doesn’t get shared automatically. That combination is getting harder and harder to find.

And there’s something else most people don’t talk about, but it’s a game changer for long-term planners:

If you hold permanent residency for five years, you can apply for Guatemalan citizenship by naturalization.

And yes, in most cases, that doesn’t mean giving up your current passport.

In other words: Guatemala doesn’t just offer fiscal flexibility, it gives you a second legal escape route if you ever need it.

Options for investors, freelancers, and retirees

With just $1,250 USD/month in income, you can qualify for permanent residency.

If you invest in real estate or a local business, the process speeds up, you can get a visa through a real estate or commercial investment of around $60,000 USD.

Local tax rates are incredibly low: 5–7% on Guatemalan-source income, and capital gains are taxed at just 10%.

For retirees, Guatemala is especially attractive: no tax on foreign pensions, low cost of living, and year-round spring-like weather.

What to consider

Security is uneven, public services are limited, and Guatemala doesn’t have many tax treaties.

That’s why Javier ultimately chose not to settle there. But in rural and expat-friendly areas like Antigua, Lake Atitlán, and Quetzaltenango, strong international communities are already established.

If your income is foreign-sourced and you value privacy, legality, and efficiency, Guatemala stands out as one of the most attractive tax residencies for expats in 2025, a place that combines flexibility, concrete benefits, and some of the lowest barriers to entry in the world.

How to Choose the Right Country Based on Your Tax Profile and Lifestyle

Are you a freelancer, investor, passive income earner, or retiree? Not everyone needs the same thing.

The most common mistake when searching for low-tax countries for expats is assuming there’s a single “best” option for everyone.

The truth? Your professional profile, income level, travel needs, and even your nationality completely reshape which tax residency makes the most sense for you.

What should you prioritize—taxes, privacy, or migration stability?

- Low tax burden: Look for countries that don’t tax foreign income or offer simple flat-tax systems.

- No CRS: Essential if you want to maintain financial privacy without automatic data sharing.

- Accessible residency: If you don’t have time or patience for endless paperwork.

- Cost of living and healthcare: Find the right balance between infrastructure and affordability.

What no one tells you: don’t wait for it to trend

Javier made the mistake of waiting. He thought the system might improve, that “maybe Portugal would go back to the way it was.”

What he got instead was more taxes, fewer benefits, and tighter control.

The best countries to legally pay 0% tax in Latin America, Asia, or Africa are just starting to get noticed—and that’s risky.

Once a place becomes popular, the influencers arrive, Telegram groups explode, prices rise, and the government starts looking closer.

So if you’re considering how to legally pay fewer taxes in Guatemala, or how to secure permanent residency in Namibia, don’t wait.

These windows don’t stay open forever.

Conclusion: Going off the map is also a strategy

In the end, Javier chose Armenia. It works for him. Clear rules, low tax, no automatic surveillance.

In a world where major fiscal centers are saturated, taxes are rising, and the CRS watches your every banking move, betting on lesser-known destinations isn’t crazy, it’s smart strategy.

You can take a different route.

Armenia, North Macedonia, Namibia, and Guatemala aren’t trendy.

But they offer what’s most scarce right now:

freedom, legality, and real fiscal efficiency for expats, entrepreneurs, and digital nomads.

And if we’ve learned anything in the past few years, it’s this:

The best destinations aren’t the ones everyone’s talking about.

They’re the ones that let you live, and build, without fear.

Want to know which one fits your life best?

👉 Book a consultation with our team

Let’s design your tax strategy before the rules change.