best countries for digital nomad families in 2025: In 2025, Western families are not just facing a crisis — they’re being slowly suffocated. Out-of-control taxes, runaway inflation, and a cost of living that turns stability into an unreachable luxury. Meanwhile, governments keep squeezing the middle class with new tax hikes, all under the narrative of “it’s for your own good.”

Spain, for example, has approved 93 tax increases since 2018, extracting over €42 billion from its citizens. And this year, they’re planning to take another €7 billion — meaning each family will pay hundreds of euros more, while politicians carry on with their privileged lifestyle.

Faced with this reality, more and more digital nomad families are seeking a destination with low taxation, stability, and genuine quality of life — not just empty promises. This is no longer just about paying less taxes, it’s about taking back control of your future and finding a country where hard work isn’t punished.

But relocating isn’t a decision you can take lightly. One wrong move and you could end up in a country with legal uncertainty, an unpredictable tax system, or poor public services. This is not about improvising — it’s about making an informed choice.

If you’re ready to exit this endless cycle of financial pressure, this article is for you. You’ll find the best countries for digital nomad families in 2025 — destinations that offer fiscal flexibility, security, and a life where you’re not just surviving every new crisis.

Let’s get to it.

Indice del artículo

The Economic and Fiscal Crisis in the West in 2025

The relentless rise of taxes and its impact on families

Tax hikes in Spain and across Europe

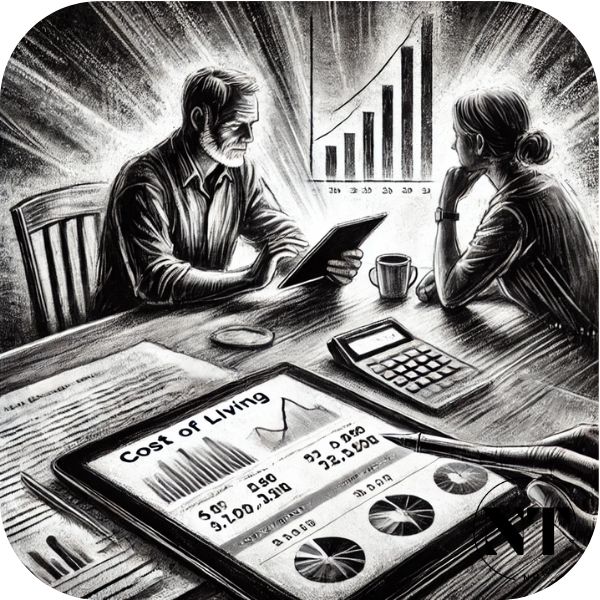

In 2025, Spain rolled out a series of aggressive tax increases that hit families hard. The government announced an unprecedented €60 billion tax plan, equivalent to the country’s entire annual education budget — or double the revenue from corporate taxes. This created a disproportionate burden for citizens already struggling with high inflation and stagnant growth.

Among the key measures, the income tax on capital gains over €300,000 was raised from 28% to 30%, while a VAT increase on essential goods is expected, directly impacting household budgets. These decisions highlight growing concerns about Spain’s high tax pressure, placing it far behind low-tax countries for expatriates and other nations with low taxation and high quality of life.

Across Europe, after a temporary market correction due to rising interest rates, housing prices have surged again with the normalization of monetary policies. This has renewed interest in countries with affordable cost of living for families, especially among those looking for emerging destinations for digital nomads.

At the same time, prices for basic goods and services have risen, eroding the purchasing power of families. These increases — combined with soaring housing costs — have widened social inequality and made it harder for young people to achieve economic independence. As a result, many are seeking residency options for digital nomads, aiming to relocate to countries that offer low taxation and real opportunities.

Why Families Are Seeking Alternatives Abroad

Lack of Economic and Political Stability

The lack of economic and political stability in many Western countries has led numerous families to consider relocating. Constant tax policy changes and the perception of poor economic management create uncertainty.

For example, in Spain, financial experts have warned about aggressive tax practices targeting wealthy foreign residents, causing many to reconsider their residency. This situation has increased interest in low-tax countries with high quality of life and emerging destinations for digital nomads, where stability is a priority.

High Tax Pressure and Lack of Incentives for Expats

The high tax burden in countries like Spain, France, and Germany, combined with a lack of real incentives for expats and digital nomads, has pushed many families to explore tax free countries options in Europe and beyond.

Additionally, Europe’s lack of pro-investment and entrepreneurship policies makes it less attractive for relocation. In contrast, many emerging destinations for digital nomads are implementing tax incentives to attract foreign talent and capital, making relocation easier with flexible visas and low entry barriers.

Security and Political Stability

Countries with Low Crime Rates and Stable Governments

Security and political stability are essential for your family’s well-being. Countries like Andorra and the United Arab Emirates (UAE) stand out for their low crime rates and strong political systems.

- Andorra: With one of the lowest crime rates in Europe, this microstate in the Pyrenees offers absolute safety and political stability.

- UAE: Dubai and Abu Dhabi are among the safest cities in the world, with strict laws ensuring public security.

- El Salvador: The country has undergone a major security transformation, with a drastic reduction in crime in recent years thanks to the policies of Nayib Bukele.

Tax Benefits and Advantages for Digital Nomads

Countries with Low Taxes or Territorial Taxation

If you want to optimize your taxes, these are the best countries for expatriates:

- Cyprus: Thanks to the Non-Dom regime, foreigners can live up to 17 years tax-free on dividends and interest earned abroad.

- Paraguay: Operates under a territorial tax system, meaning you only pay taxes on income earned within the country. Foreign earnings are 100% tax-exempt.

- Panama: Its territorial tax system allows residents to be taxed only on locally generated income. Additionally, its Permanent Residency for Foreigners is one of the most flexible programs available.

Visas and Easy Residency Requirements

Countries with Fast and Simple Residency Processes

If you want to relocate without excessive bureaucracy, these countries offer straightforward residency options:

- Paraguay: You can obtain permanent residency within months with a minimal investment.

- UAE: Offers Remote Work Visas and the Golden Visa for investors and qualified professionals.

- Andorra & Cyprus: These countries have stricter requirements, often requiring minimum investments to secure residency.

Quality of Life and Education

Countries with the Best Infrastructure and Public Services

- UAE: Has one of the best infrastructures in the world, with top-tier transportation, healthcare, and public services.

- Andorra: Offers a high standard of living, with European-quality education and healthcare.

- Panama & Cyprus: These countries are rapidly developing their infrastructure, making them ideal for families seeking a balance between cost and quality.

Cost of Living and Investment Opportunities

Destinations with High ROI for Expats

- Paraguay: The most affordable country on this list, with low living costs and investment opportunities in real estate and agribusiness.

- UAE: A luxury destination with higher costs, but high salaries and strong profitability for international businesses.

Best Countries for Digital Nomad Families in 2025

Cyprus: A Balance Between Low Taxes and Quality of Life

Non-Dom Program and Tax Exemptions

Cyprus offers the Non-Dom Program, allowing foreign residents to benefit from significant tax exemptions. This status exempts individuals from the Special Defense Contribution (SDC) tax on dividends, interest, and rental income for 17 years. Additionally, only a symbolic 2.65% contribution to the national healthcare system (GESY) is required on dividends, capped at €4,770.

Cost of Living and International Community

The cost of living in Cyprus is relatively affordable compared to other European countries. Cities like Nicosia and Limassol offer a wide range of services at reasonable prices. Cyprus also boasts a vibrant international community, making it easier for expat families to integrate.

Risks of Potential EU Legislative Changes

Although Cyprus is attractive due to its favorable tax regime, it is important to consider that, as an EU member, it is subject to possible regulatory changes that could impact its tax policies. For example, other EU countries have recently abolished similar programs, indicating a trend toward fiscal harmonization across Europe.

👉 Want to know the exact requirements and best strategies for obtaining residency in Cyprus? Check out our detailed guide here.

Andorra: Low Taxation with Strict Requirements

Conditions for Obtaining Tax Residency

To obtain tax residency in Andorra, applicants must meet specific requirements:

- Effective residency: Spend more than 183 days per year in the country.

- Economic ties: Establish the main source of income or investments in Andorra.

- Family ties: Have direct relatives residing in the country.

Entry Costs and Quality of Life in Andorra

Andorra requires a significant financial commitment to secure residency:

- Refundable deposit: €50,000 deposited with the Andorran Financial Authority, plus €10,000 per dependent.

- Additional investment: Applicants must invest in Andorran assets, with the amount depending on the type of residency requested.

In exchange, Andorra offers a high quality of life, low crime rates, breathtaking natural landscapes, and top-tier healthcare and education services. However, the cost of living can be high, particularly in terms of housing and services. According to recent data, a single adult needs at least €39,000 per year to live comfortably in Andorra.

👉 Want to know the exact requirements and best strategies for obtaining residency in Andorra? Check out our detailed guide here.

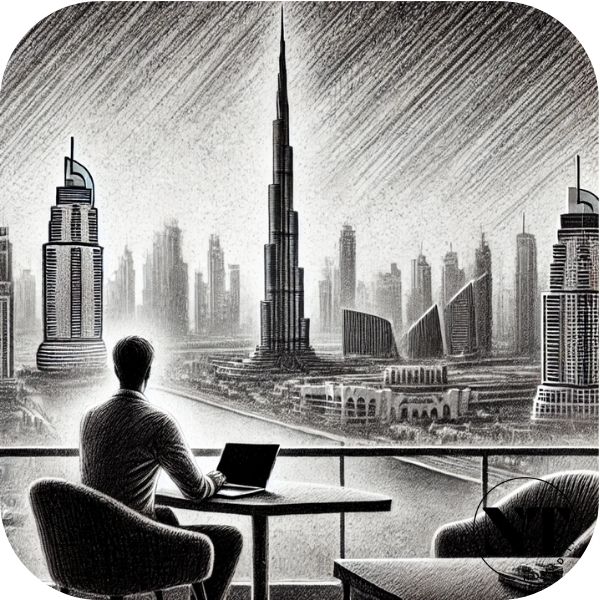

United Arab Emirates: Zero Taxes and Modern Luxury

The UAE remains the top destination for those seeking zero income taxes and a high-end lifestyle. The country offers multiple residency options, including:

- Golden Visa: A 10-year residency for investors, entrepreneurs, and skilled professionals.

- Remote Work Visa: For employees and freelancers earning income from abroad.

- Investor Visa: Available for those who purchase property or establish a business in the UAE.

The UAE stands out for its world-class infrastructure, safety, and business opportunities in sectors like technology and finance. However, maintaining tax residency requires meeting key criteria, such as spending at least six months per year in the country.

👉 Want to know the exact requirements and best strategies for obtaining residency in Dubai or Abu Dhabi? Check out our detailed guide here.

Paraguay: Easy Residency and Territorial Taxation

If you’re looking for a low-tax destination with an affordable cost of living, Paraguay is a top option.

- Easy residency: Obtain permanent residency in just a few months with accessible requirements.

- Territorial taxation: You only pay taxes on income generated within Paraguay, allowing for full tax optimization.

- Low cost of living: Housing, services, and food at highly competitive prices.

- Economic stability: Sustained growth and pro-investment policies for foreigners.

Paraguay remains an undiscovered tax haven, perfect for those seeking flexibility and economic security in Latin America.

👉 Want to know the step-by-step process for obtaining Paraguayan residency and its tax benefits? Check out our detailed blog here.

Panama & El Salvador: Emerging Destinations with Tax Advantages

If you’re considering Latin America for its tax incentives and stability, these two countries offer attractive opportunities:

- Panama: Its territorial tax system means foreign income is tax-free. Additionally, its residency program is fast and accessible for expatriates.

- El Salvador: A global crypto hub, being the first country to adopt Bitcoin as legal tender, offering tax exemptions for crypto investors.

Both countries offer flexible visas, strong infrastructure, and competitive living costs.

👉 Interested in relocating to Panama or taking advantage of El Salvador’s tax benefits? Explore our full blog guide here.

Uruguay: Security and Quality of Life with Mixed Taxation

Uruguay is an ideal choice for those prioritizing security and stability, although its tax regime has some limitations:

- Tax benefits for new residents: Temporary exemptions on foreign income, making the transition easier.

- Mixed taxation: While initial benefits exist, long-term tax pressure is higher than in other regional destinations.

Uruguay stands out for its high quality of life, efficient public services, and economic stability. However, evaluating whether its tax system aligns with your long-term strategy is crucial.

👉 Want to explore the pros and cons of Uruguay’s tax system? Read our in-depth analysis here.

Asia as a Destination: Opportunities and Migration Barriers

Asia offers exciting opportunities for expatriates, but many come with migration restrictions or high costs:

- Malaysia: The MM2H (Malaysia My Second Home) program allows long-term residency but requires high income and significant bank deposits.

- Thailand: Attractive for its low cost of living, but complex visa regulations make obtaining permanent residency difficult.

- Philippines & Indonesia: Both offer territorial taxation, but unstable regulations and long-term residency challenges are key factors to consider.

While Asia excels in infrastructure and affordability, understanding migration and tax requirements is essential before making a decision.

👉 For more insights on each country’s tax and residency benefits, check our blog on Asia as a fiscal destination.

Emerging Options: Georgia and Montenegro

For those looking for attractive tax policies and high quality of life outside mainstream destinations, these countries offer interesting opportunities:

- Georgia: Microbusinesses are taxed at just 1%, and crypto earnings are tax-free. However, recent political instability is a factor to consider.

- Montenegro: Not a pure tax haven, but its low tax burden and investor-friendly environment make it a balanced choice for expats.

Both countries offer simplified bureaucracy and relatively flexible residency programs, making them appealing emerging destinations.

👉 Curious about Georgia or Montenegro and how they fit into your tax strategy? Read our detailed blog analysis here.

Conclusion & Next Steps

The world is full of options for expatriates and digital nomad families seeking low taxation, high quality of life, and long-term stability. From established hubs like UAE and Panama to emerging opportunities in Georgia and Montenegro, the key is finding a country that aligns with your financial and personal goals.

This is not just about paying fewer taxes—it’s about living with security and peace of mind, protecting your wealth, and ensuring a stable future.

📌 Ready to make the move? Our team is here to help you design the best tax strategy for your case. Book your consultation today!