STRATEGIC LIFESTYLE & LOCATION INSIGHTS FOR GLOBAL ENTREPRENEURS

We help digital nomads and global professionals navigate international relocation, taxes and lifestyle optimization — from our personal experience.

Why Choose Nomad Tax

Discover how Nomad Tax can transform your international tax planning.

Personalized Consulting

Personalized Consulting: tailor-made plan designated to optimize your taxes and meet your personal goals, both personal and business.

Real-World Experience

We don’t provide tax advice – we share our own tested strategies for living and working across multiple jurisdictions.

Strategic Destinations

More than 20 countries with favorable tax regimes, including Emirates, Panama, El Salvador and Cyprus.

Who is Nomad Tax for?

Make your money work for you, not against you. Discover how international tax regimes can change the way you operate, protect and grow your income and assets.

Digital Entrepreneurs and Freelancers

- Optimize your Tax Burden:Structure your life for maximum location freedom, legal clarity, and long-term growth.

- Global Freedom: We help you establish tax residences that allow you to work from anywhere.

- Financial Diversification: Protect your income and create a secure financial cushion in strategic jurisdictions.

Investors and Asset Owners

- Asset Protection: Access to legal structures that preserve your assets.

- Estate Planning: Create a strong legacy with solutions in trusts, holdings and international real estate.

- Advantages in Cryptocurrencies: Explore international legal tools for wealth mobility, diversification, and asset protection.

Growth Companies and Startups

-

Intelligent Tax Structuring: We share strategies and introductions that have worked for scaling global businesses.

- Access to Emerging Markets: Open new business opportunities in strategic countries.

- Cost Optimization: Minimize tax and administrative expenses while scaling your business.

What Can We Talk About?

At Nomad Tax, we understand that every client has unique needs. Whether you are looking to optimize your taxes, structure your business in a favorable tax jurisdiction, obtain international tax residency or protect your assets, we are here to help.

Mobility

- Tax Residences

- Digital Nomad Visas

- Second Passports

- Immigration Procedures

- Retirement planning

Tax Optimization

- At the National level

- Internationally

- Offshore companies

- Holdings and trusts

- Double Taxation Agreements

Strategy

- International Banking

- Perpetual Tourist

- Asset protection

- Repatriation of Funds

- Estate Planning

Business

- Real Estate Investments

- Optimization with Crypto

- Online Business

- Tax Risk Management

- Project Financing

What is Nomad Tax?

Nomad Tax is a global insights platform created by and for digital nomads.

We can speak freely without any restrictions. We are experienced global professionals who’ve lived across dozens of countries and built legal, location-flexible lifestyles that protect our time, freedom, and income.

Through personalized calls and curated networks of local specialists, we help you navigate your own journey — without giving you tax, legal, or financial advice.

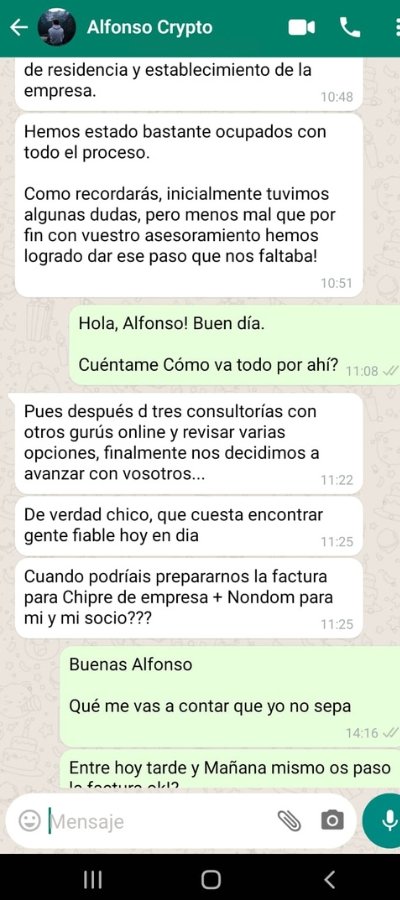

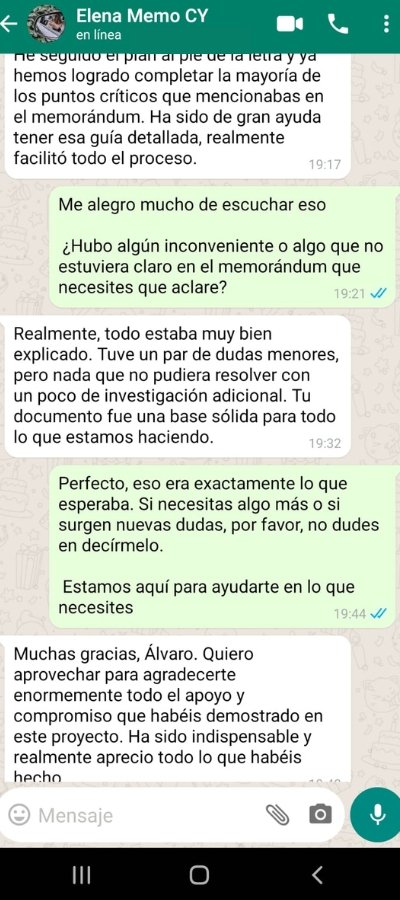

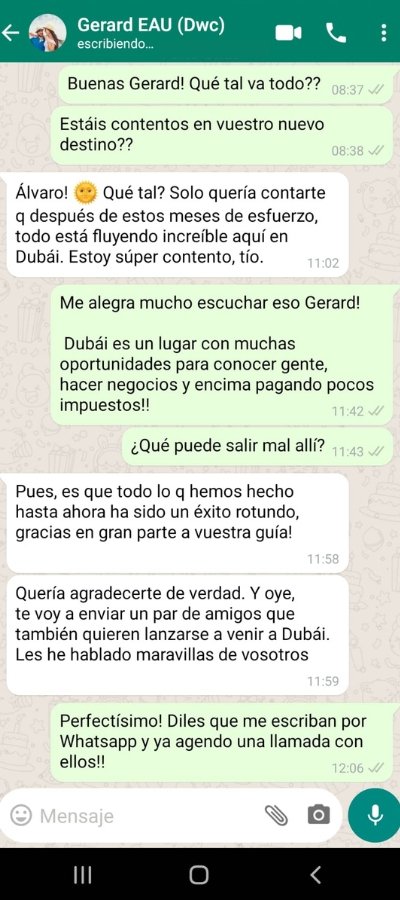

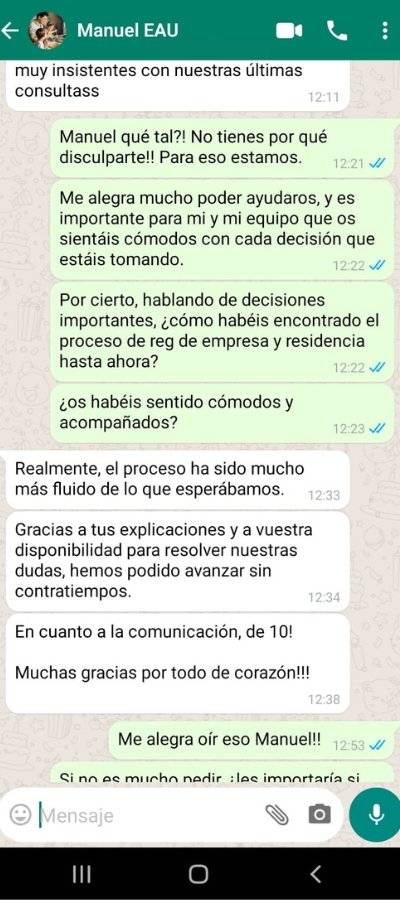

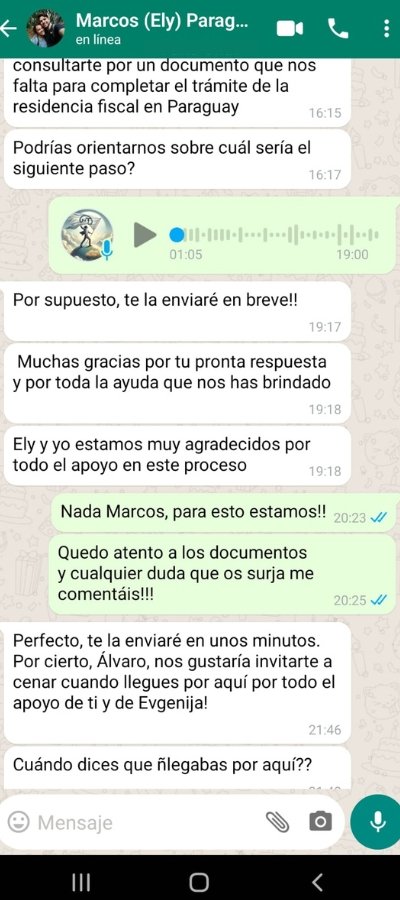

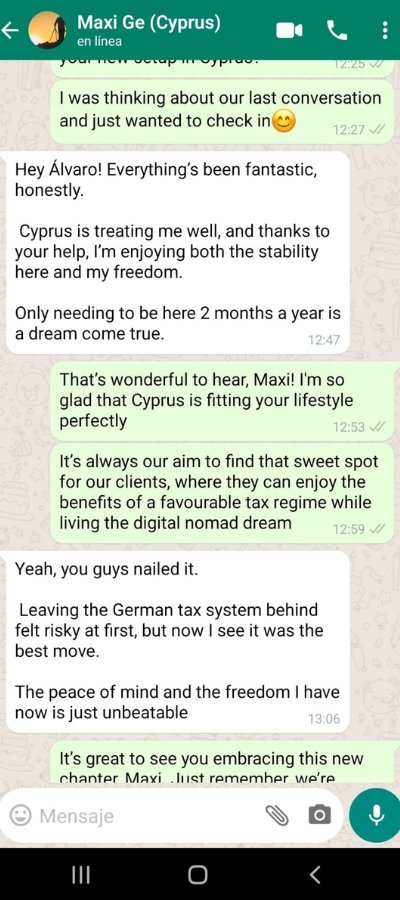

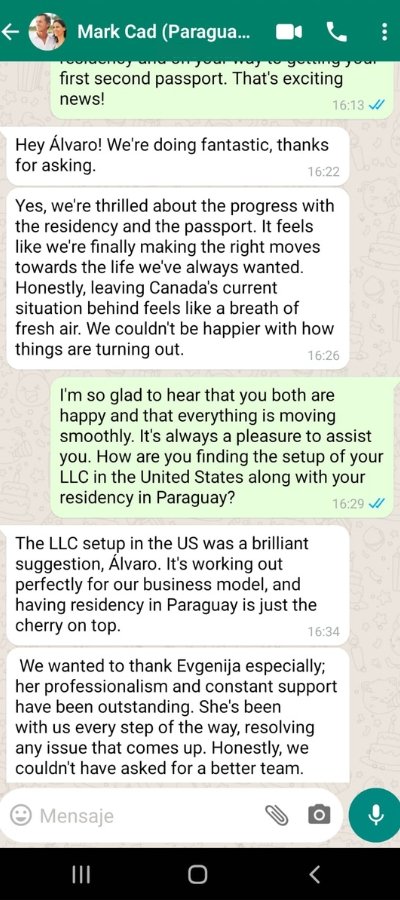

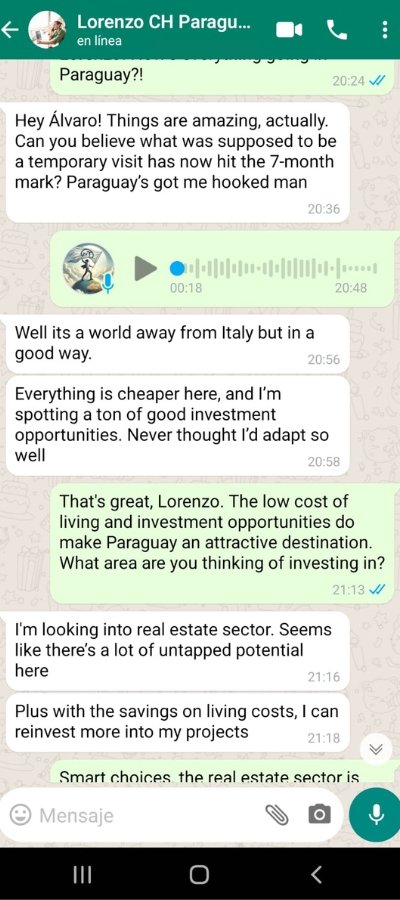

What do our customers say about us?